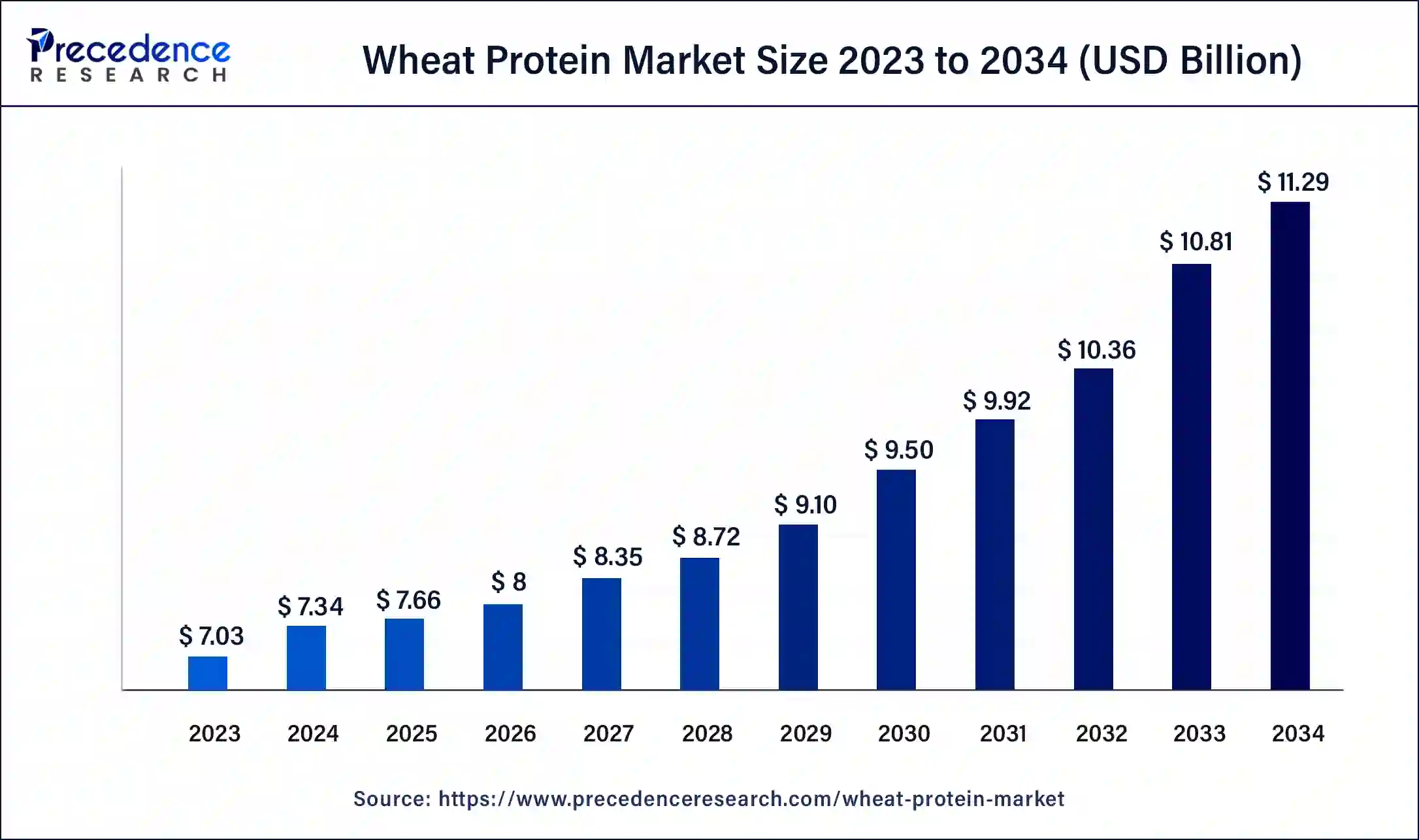

The global wheat protein market size was estimated at USD 7.03 billion in 2023 and is projected to reach around USD 10.69 billion by 2033, growing at a CAGR of 4.28% from 2024 to 2033.

Key Points

- North America held the largest share of the 34% in 2023.

- Asia Pacific is expected to witness the at fastest CAGR of 5.23% in the market during the forecast period.

- By product, the wheat gluten segment has contributed more than 46% of market share in 2023.

- By product, the hydrolyzed wheat protein segment is projected to grow at a CAGR of 4.92% during the forecast period.

- By form, the dry segment held the largest share of the market in 2023.

- By concentration, the 75% segment led the market in 2023.

- By application, the bakery & confectionery segment has accounted for the largest market share of 41% in 2023.

- By application, the dairy segment is expected to show significant growth during the forecast period.

The wheat protein market is witnessing significant growth globally, driven by increasing consumer demand for plant-based protein sources, rising health consciousness, and growing awareness about the benefits of wheat protein in various applications. Wheat protein, derived from wheat grains, is gaining traction as a versatile ingredient in food, beverages, dietary supplements, and personal care products due to its nutritional value, functional properties, and sustainability credentials. As the market continues to expand, key players are focusing on product innovation, strategic partnerships, and geographical expansion to capitalize on emerging opportunities and gain a competitive edge.

Get a Sample: https://www.precedenceresearch.com/sample/4004

Growth Factors

Several factors contribute to the growth of the wheat protein market. Firstly, the growing preference for plant-based diets, driven by health, environmental, and ethical considerations, is fueling the demand for alternative protein sources like wheat protein. Additionally, the increasing prevalence of health issues such as obesity, diabetes, and cardiovascular diseases is prompting consumers to adopt healthier dietary choices, further boosting the consumption of wheat protein products. Moreover, advancements in food processing technologies and the development of novel extraction methods are enhancing the functionality and versatility of wheat protein, expanding its applications across various industries.

Region Insights

The wheat protein market exhibits a global presence, with significant growth observed across various regions. North America dominates the market, driven by the increasing adoption of plant-based diets, rising consumer awareness about health and wellness, and the presence of key players focusing on product innovation. Europe follows closely, characterized by a well-established food and beverage industry, growing demand for clean-label and natural ingredients, and favorable government regulations promoting sustainable food production practices. Asia Pacific emerges as a lucrative market, propelled by changing dietary habits, rising disposable incomes, and the growing popularity of vegan and vegetarian lifestyles in countries like China and India.

Wheat Protein Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 7.03 Billion |

| Global Market Size by 2033 | USD 10.69 Billion |

| U.S. Market Size in 2023 | USD 1.79 Billion |

| U.S. Market Size by 2033 | USD 2.74 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Form, By Concentration, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wheat Protein Market Dynamics

Drivers

Several drivers are propelling the growth of the wheat protein market. One of the primary drivers is the shifting consumer preferences towards plant-based protein sources, driven by concerns regarding animal welfare, environmental sustainability, and personal health. Additionally, the expanding applications of wheat protein in food and beverage formulations, including bakery products, meat analogs, and nutritional supplements, are driving market growth. Furthermore, increasing investments in research and development activities to enhance the functional properties and nutritional profile of wheat protein are stimulating market expansion.

Opportunities

The wheat protein market presents numerous opportunities for growth and innovation. One key opportunity lies in the development of wheat protein-based functional ingredients and additives for use in a wide range of food and beverage applications, including emulsification, foaming, and gelling. Moreover, the rising demand for gluten-free and allergen-free products creates opportunities for the development of wheat protein isolates and hydrolysates suitable for consumers with dietary restrictions. Furthermore, expanding into emerging markets with growing health and wellness trends presents untapped opportunities for market players to diversify their product portfolios and expand their customer base.

Challenges

Despite the favorable growth prospects, the wheat protein market faces several challenges that may impede its growth trajectory. One of the primary challenges is the potential for cross-contamination with gluten, which poses a risk for individuals with gluten-related disorders such as celiac disease. Mitigating this risk requires strict quality control measures and adherence to gluten-free certification standards. Additionally, the fluctuating prices of raw materials, such as wheat grains, can impact the profitability of wheat protein manufacturers and affect pricing strategies. Furthermore, competition from alternative plant-based protein sources and the emergence of novel protein ingredients pose challenges for market incumbents to differentiate their offerings and maintain market share.

Read Also: PV Inverters Market Size to Rake USD 73.07 Billion by 2033

Recent Developments

- In November 2023, Amber Wave, a leading U.S. supplier of premium wheat protein, proudly unveiled its latest milestone—the inauguration of North America’s largest wheat protein ingredients facility. This achievement follows substantial investment from Summit Agricultural Group, an esteemed agribusiness operator and investment manager.

- In September 2023, British alternative meat brand Squeaky Bean made another step into diversification with the introduction of its latest offerings, the Teriyaki Duck Protein Pot and the Beef Ragu Protein Pot. These ready-to-eat meals cater to varied tastes and preferences, showcasing the brand’s commitment to providing innovative plant-based options.

Wheat Protein Market Companies

- Archer Daniels Midland Company

- Agridient

- MGP Ingredients

- AB Amilina

- Cargill Inc

- Manildra Group

- Crespel & Deiters GmbH and Co. KG

- Kroener Staerke

- Crop Energies AG

- Roquette

Segments Covered in the Report

By product

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

- Others

By Form

- Dry

- Liquid

By Concentration

- 75% Concentration

- 80% Concentration

- 95% Concentration

By Application

- Bakery & Confectionery

- Animal Feed

- Dairy

- Personal Care

- Sports & Nutrition

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/