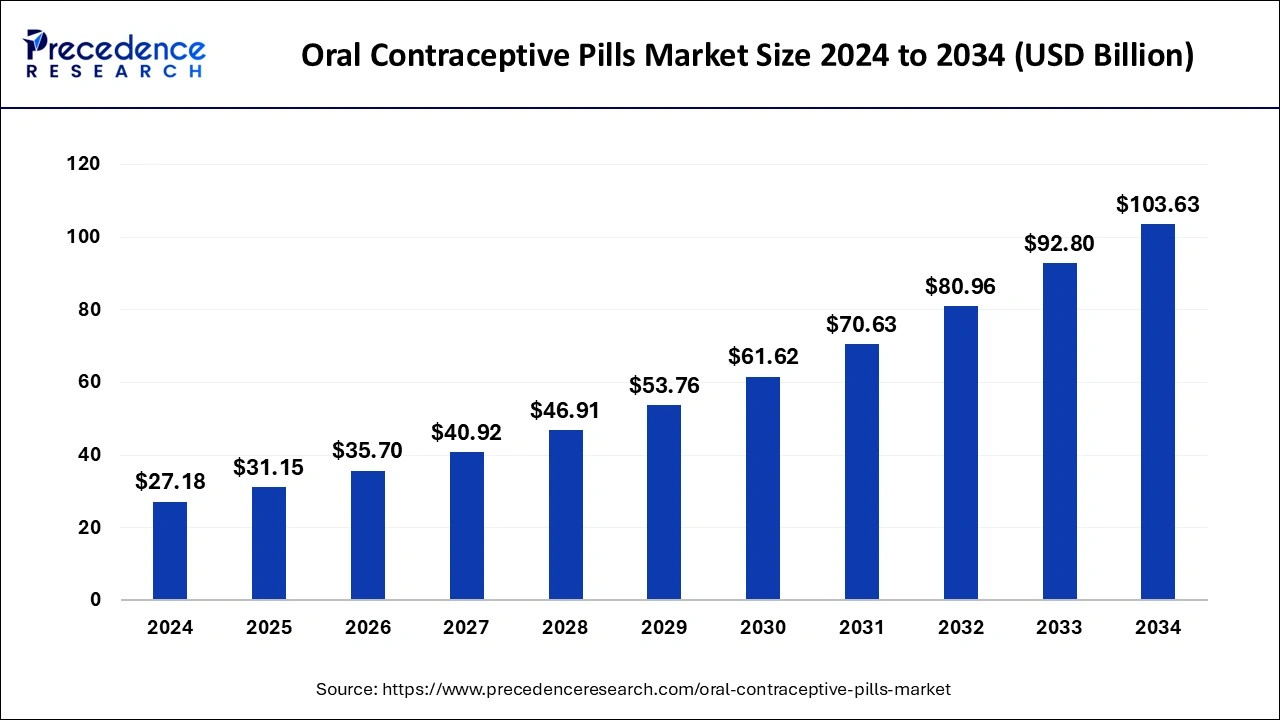

The global oral contraceptive pills market size was estimated at USD 23.71 billion in 2023 and is projected to reach around USD 92.80 billion by 2033, expanding at a CAGR of 14.62% from 2024 to 2033.

Key Points

- North America dominated the oral contraceptive pills market in 2023.

- Asia Pacific is observed to witness the fastest rate of growth during the forecast period.

- By type, the progestin only segment held a significant share of the market in 2023.

- By category, the branded segment dominated the oral contraceptive pills market.

- By distribution channel, the retail pharmacy segment dominated the market in 2023.

The oral contraceptive pills market is a vital segment within the pharmaceutical industry, playing a pivotal role in women’s reproductive health and family planning. Oral contraceptive pills, commonly referred to as birth control pills, are medications taken daily by women to prevent pregnancy. They contain synthetic hormones that mimic the effects of naturally occurring hormones in the female body, primarily estrogen and progestin.

Get a Sample: https://www.precedenceresearch.com/sample/4159

Growth Factors:

Several factors contribute to the growth of the oral contraceptive pills market. Increasing awareness about family planning and the importance of contraception in preventing unintended pregnancies drives demand for oral contraceptives. Moreover, advancements in pharmaceutical technology have led to the development of newer formulations with improved efficacy, safety, and convenience, further expanding the market. Additionally, favorable government initiatives and policies promoting access to contraception, along with increasing healthcare expenditure, support market growth.

Region Insights:

The oral contraceptive pills market exhibits regional variations influenced by cultural norms, healthcare infrastructure, and regulatory frameworks. Developed regions such as North America and Europe have well-established markets with high penetration rates of oral contraceptives. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth due to improving healthcare infrastructure, rising disposable incomes, and increasing awareness about contraception.

Oral Contraceptive Pills Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.62% |

| Global Market Size in 2023 | USD 23.71 Billion |

| Global Market Size in 2024 | USD 27.18 Billion |

| Global Market Size by 2033 | USD 92.80 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Category, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oral Contraceptive Pills Market Dynamics

Drivers:

Several drivers propel the growth of the oral contraceptive pills market globally. Women’s empowerment and the desire for reproductive autonomy drive demand for contraceptives, including oral contraceptives. Furthermore, the convenience and effectiveness of oral contraceptive pills compared to other contraceptive methods, such as condoms or intrauterine devices (IUDs), contribute to their popularity. Additionally, the expansion of over-the-counter (OTC) availability of certain oral contraceptive formulations in some regions enhances accessibility and convenience for consumers, driving market growth.

Opportunities:

The oral contraceptive pills market presents significant opportunities for pharmaceutical companies to innovate and diversify their product offerings. There is a growing demand for contraceptive pills with reduced side effects and improved user compliance, driving research and development efforts in the industry. Moreover, expanding market penetration in underserved regions, such as rural areas and developing countries, presents untapped growth opportunities. Furthermore, strategic partnerships and collaborations between pharmaceutical companies and healthcare organizations can facilitate access to contraceptives and promote education about family planning, expanding the market further.

Challenges:

Despite the growth prospects, the oral contraceptive pills market faces several challenges. Concerns about potential side effects and health risks associated with long-term use of oral contraceptives, such as cardiovascular complications and hormonal imbalances, pose challenges to market acceptance and consumer confidence. Additionally, regulatory hurdles and compliance requirements vary across countries, affecting market entry and product distribution. Furthermore, cultural and religious factors may influence contraceptive use and acceptance in certain regions, posing challenges to market expansion. Addressing these challenges requires concerted efforts from stakeholders, including healthcare providers, policymakers, and pharmaceutical companies, to ensure safe and effective access to oral contraceptives for women worldwide.

Read Also: Dental Cleaning Tablets Market Size, Growth Report by 2033

Oral Contraceptive Pills Market Recent Developments

- In March 2024, the over-the-counter birth control drug Perrigo Opill has been dispatched to major retailers and pharmacies in the United States and will be available in shops and online later. Opill is scheduled to hit store shelves that focus on consumer self-care items.

- In December 2023, a ground-breaking step toward shared responsibility in contraception, UK researchers launched the first stage of testing for a novel non-hormonal birth control tablet for men.

- In April 2023, in an open letter signed on Monday, executives from over 300 biotech and pharmaceutical companies, including Pfizer and Biogen, called for the reversal of a federal judge’s order to halt the sale of the abortion drug mifepristone.

Oral Contraceptive Pills Market Companies

- Pfizer Inc.

- Johnson & Johnson

- Merck & Co. Inc.

- Novartis AG

- AbbVie Inc.

- Bayer AG

- Sanofi S.A.

- GlaxoSmithKline PLC

- Zydus Lifesciences Ltd

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd.

- Church & Dwight Co Inc.

- Aurobindo Pharma Limited

- Cipla Inc.

- Dr. Reddy’s Laboratories Ltd

- Ferring B.V

- Amneal Pharmaceuticals LLC

- Lupin Pharmaceuticals Inc.

- Vardhaman Lifecare Pvt. Ltd

- Glenmark Pharmaceuticals

- Piramal Enterprises Ltd.

- Mankind Pharma Ltd.

- Sopharma AD

- Mayne Pharma

- HLL Lifecare Limited

- Famy Care Ltd

- Syzygy Healthcare

- V Care Pharma

- Actavis PLC

- Mylan N.V.

Segments Covered in the Report

By Type

- Combination

- Monophasic

- Triphasic

- Others

- Progestin Only

- Others

By Category

- Generic

- Branded

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Clinics

- Online

- Public Channel And NGO

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/