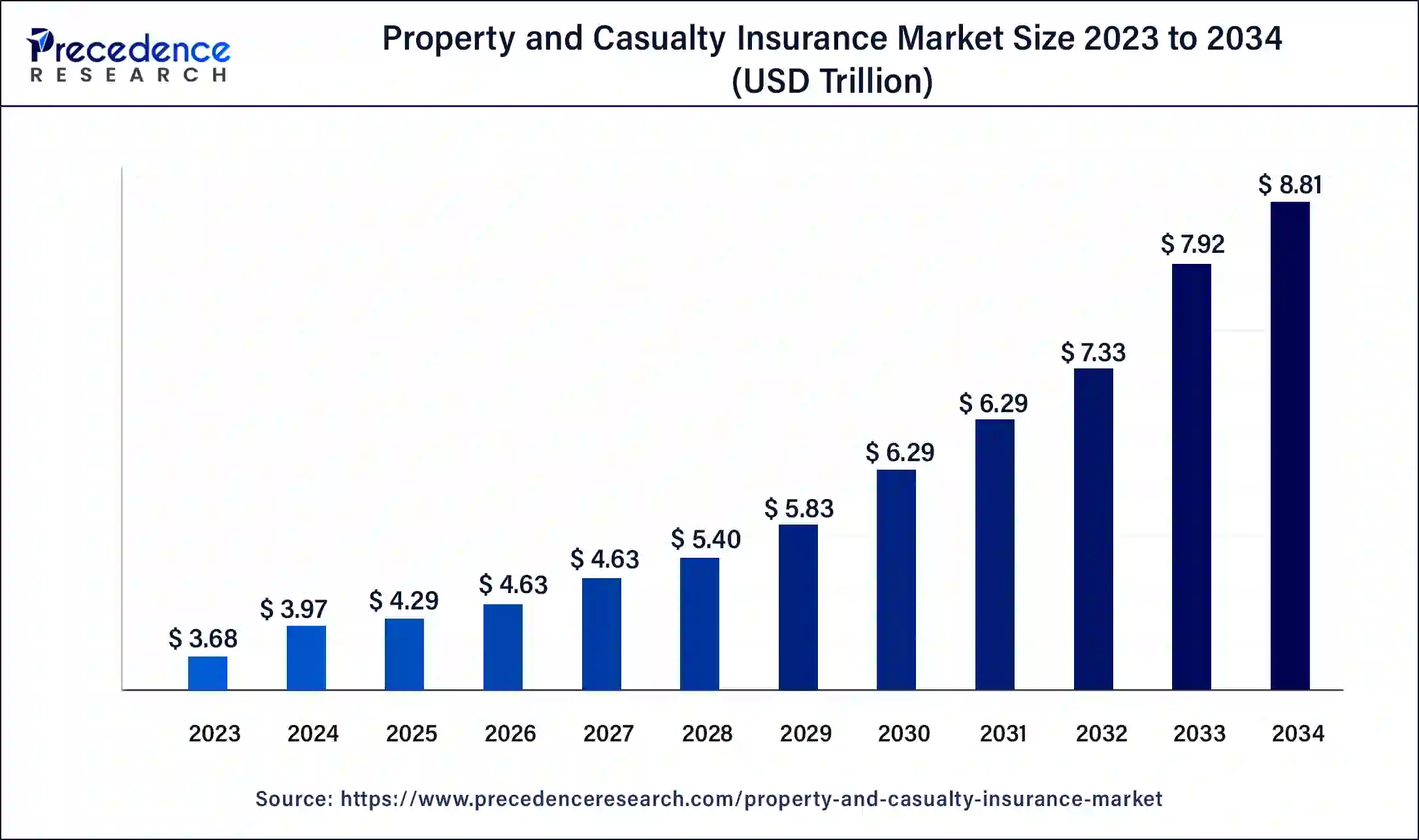

The global property and casualty insurance market size was estimated at USD 3.68 trillion in 2023 and is projected to reach around USD 7.92 trillion by 2033, growing at a CAGR of 7.96% from 2024 to 2033.

Key Points

- The North America property and casualty insurance market size was calculated at USD 1.18 trillion in 2023 and is expected to attain around USD 2.53 trillion by 2033.

- North America led the market with the largest market share of 32% in 2023.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By product, the homeowners insurance segment has held the largest market share of 38% in 2023.

- By distribution, the brokers segment dominated the market in 2023.

- By distribution, the tied agents and branches segment is expected to grow at the fastest rate during the forecast period.

- By end-users, the individual segment has accounted more than 57% of market share in 2023.

- By end-users, the business segment is expected to grow at the fastest rate during the forecast period.

The property and casualty insurance market encompasses a wide range of insurance products designed to protect individuals, businesses, and assets from various risks. This market segment plays a critical role in mitigating financial losses associated with property damage, liability claims, and other unforeseen events. Property insurance provides coverage for physical assets such as homes, buildings, and vehicles, while casualty insurance covers liability risks, including bodily injury and property damage to third parties.

Get a Sample: https://www.precedenceresearch.com/sample/4156

Growth Factors:

Several factors drive growth in the property and casualty insurance market. Population growth and urbanization contribute to increased demand for property insurance, particularly in areas prone to natural disasters and extreme weather events. Additionally, regulatory mandates and contractual requirements compel businesses and individuals to purchase liability insurance to protect against legal liabilities. Technological advancements, such as data analytics and telematics, enable insurers to better assess risks, streamline underwriting processes, and offer more personalized insurance products, driving market growth.

Region Insights:

The property and casualty insurance market exhibits regional variations influenced by factors such as economic development, regulatory frameworks, and exposure to natural catastrophes. Developed markets like North America and Western Europe have well-established insurance industries with high penetration rates. In emerging markets such as Asia-Pacific and Latin America, rising disposable incomes, urbanization, and infrastructure development drive demand for property and casualty insurance. However, challenges such as regulatory complexity, underdeveloped distribution channels, and low insurance awareness limit market growth in some regions.

Property and Casualty Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.96% |

| Global Market Size in 2023 | USD 3.68 Trillion |

| Global Market Size in 2024 | USD 3.97 Trillion |

| Global Market Size by 2033 | USD 7.92 Trillion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Distribution, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Property and Casualty Insurance Market Dynamics

Drivers:

Key drivers of growth in the property and casualty insurance market include increasing awareness of risk management among businesses and individuals, coupled with a growing recognition of the importance of insurance protection. Regulatory changes and evolving consumer expectations also drive demand for innovative insurance products that offer comprehensive coverage and tailored solutions. Furthermore, the emergence of new risks, such as cyber threats and climate change-related events, creates opportunities for insurers to develop specialized coverage offerings and expand their market presence.

Opportunities:

The property and casualty insurance market presents opportunities for insurers to innovate and differentiate themselves in a competitive landscape. Technological advancements, such as artificial intelligence and blockchain, enable insurers to enhance operational efficiency, improve claims processing, and deliver personalized customer experiences. Expansion into emerging markets offers growth opportunities, particularly in regions with underinsured populations and growing middle-class segments. Additionally, partnerships with insurtech startups and ecosystem players allow insurers to leverage new distribution channels and enhance product offerings to meet evolving customer needs.

Challenges:

Despite growth opportunities, the property and casualty insurance market faces several challenges. Increasing frequency and severity of natural disasters pose significant underwriting challenges and strain insurer solvency. Regulatory changes, such as new capital requirements and compliance obligations, increase operational complexity and costs for insurers. Moreover, cybersecurity threats and data privacy concerns present risks to insurers’ digital operations and customer data protection efforts. Additionally, persistent low interest rates and investment market volatility affect insurers’ investment income and profitability, challenging underwriting discipline and risk management practices.

Read Also: Irradiation Sterilization Services Market Size, Growth, Report By 2033

Property and Casualty Insurance Market Recent Developments

- In March 2024, Chubb launched a global transactional risk platform to offer transactional risk liability insurance products across international markets.

- In November 2023, Futuristic Underwriters and Tech-Driven MGA launched commercial P&C insurance to reduce risk and drive profitability for agents, insurers, and insureds.

- In January 2024, New MGA, a team of experts TLI, launched Sands Point Risk to support expanded opportunities in financial and property-casualty insurance lines.

- In April 2024, Beat Capital Partners is set to launch Convergence, a credit insurance company led by Stephen Pike, the founder and CEO.

- In March 2024, Future Generali India Insurance, a private general insurer, has recently launched a new product called Health PowHER that caters to the healthcare needs of women at various stages of their lives. This product provides coverage for a range of women-specific medical conditions, including increased limits for cancer treatments specific to females, and coverage for disorders related to puberty and menopause.

Property and Casualty Insurance Market Companies

- Chubb

- USAA Insurance Company

- The Travelers Indemnity Company

- CNA Financial Corp.

- Liberty Mutual Insurance Company

- Farmers Insurance Group of Companies

- State Farm Mutual Automobile Insurance Company

- Berkshire Hathaway Specialty Insurance

- Progressive Casualty Insurance Company

- Allstate Insurance Company

Segments Covered in the Report

By Product

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Landlord Insurance

- Others

By Distribution

- Tied Agents and Branches

- Brokers

- Others

By End-users

- Individuals

- Governments

- Businesses

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/