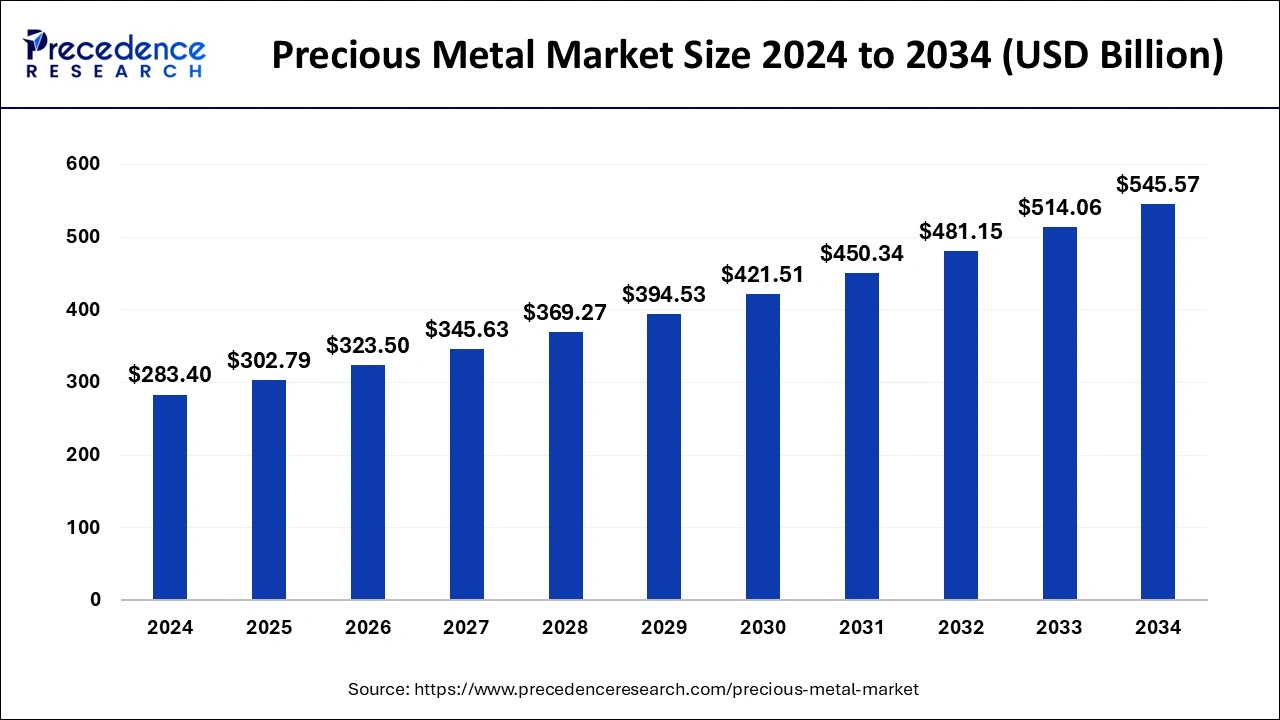

The global precious metal market size was estimated at USD 265.26 billion in 2023 and is predicted to rake around USD 514.06 billion by 2033, growing at a CAGR of 6.84% from 2024 to 2033.

Key Points

- Asia Pacific has held the largest market share of 60% in 2023.

- North America is also expected to gain a significant share of the market during the forecast period.

- By product, the gold segment dominated the market with the largest market share of 83% in 2023.

- By application, the industrial segment has contributed more than 46% of market share in 2023.

- By application, the jewelry segment is expected to witness the fastest CAGR in the market during the forecast period.

The global precious metal market encompasses a diverse range of metals prized for their rarity, beauty, and intrinsic value. Precious metals such as gold, silver, platinum, and palladium have historically served as store of value, investment assets, and industrial inputs across various sectors. The market is influenced by a myriad of factors, including economic conditions, geopolitical events, currency fluctuations, industrial demand, and investor sentiment. As traditional safe-haven assets, precious metals often exhibit counter-cyclical behavior, with demand increasing during periods of economic uncertainty and financial instability. Additionally, technological advancements and shifting consumer preferences influence the demand dynamics of precious metals, driving innovation and diversification within the market.

Get a Sample: https://www.precedenceresearch.com/sample/4051

Growth Factors

Several key factors drive the growth of the global precious metal market. Economic uncertainty and geopolitical tensions often spur demand for safe-haven assets such as gold and silver, as investors seek to protect their wealth and hedge against inflation and currency devaluation. Central banks play a significant role in shaping the demand for precious metals through their monetary policies, with many countries holding gold reserves as a form of financial security and stability. Industrial demand for precious metals remains robust, driven by their unique physical and chemical properties that make them essential components in electronics, automotive catalytic converters, jewelry manufacturing, and other industrial applications. Moreover, the proliferation of exchange-traded funds (ETFs) and other investment vehicles has democratized access to precious metals as an investment asset class, further fueling demand and liquidity in the market.

Region Insights

The global precious metal market exhibits regional variations in terms of production, consumption, and demand dynamics. Historically, regions such as Africa, South America, and Australia have been significant producers of gold, accounting for a substantial share of global production. South Africa, in particular, has a rich history of gold mining and remains a major player in the global gold market. Russia and China also play pivotal roles in the production and consumption of precious metals, with China emerging as the world’s largest consumer of gold and a major player in the platinum group metals market. In terms of consumption, regions such as Asia-Pacific, North America, and Europe are major markets for jewelry, investment, and industrial applications of precious metals, driven by growing wealth, cultural preferences, and industrial demand.

Trends

Several trends are shaping the evolution of the global precious metal market. One notable trend is the increasing focus on sustainable and responsible sourcing practices, driven by growing awareness of environmental and social issues associated with mining activities. Responsible sourcing initiatives, certification programs, and transparency efforts are gaining traction within the industry, as stakeholders seek to address concerns related to human rights violations, environmental degradation, and community engagement. Another trend is the rise of digitalization and blockchain technology in the precious metals industry, facilitating transparency, traceability, and efficiency in supply chain management and transactions. Moreover, the growing popularity of sustainable investing and environmental, social, and governance (ESG) criteria is influencing investor preferences and driving demand for ethically sourced precious metals and related financial products.

Precious Metal Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.84% |

| Global Market Size in 2023 | USD 265.26 Billion |

| Global Market Size by 2024 | USD 283.40 Billion |

| Global Market Size by 2033 | USD 514.06 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Precious Metal Market Dynamics

Drivers

Several factors drive demand for precious metals across various sectors and investor segments. Economic and financial market uncertainty, geopolitical tensions, and currency fluctuations often drive investors towards safe-haven assets such as gold and silver, which are perceived as stores of value and wealth preservation assets. Additionally, industrial demand for precious metals remains robust, driven by their unique physical and chemical properties that make them indispensable in various high-tech and industrial applications. The automotive industry, for instance, relies on platinum and palladium for catalytic converters, while the electronics sector utilizes gold and silver in electronic components and connectors. Moreover, changing consumer preferences and cultural traditions influence demand for precious metals in jewelry and ornamental applications, particularly in emerging markets with growing affluence and disposable income.

Opportunities

The global precious metal market presents numerous opportunities for stakeholders across the value chain. Mining companies have the opportunity to leverage technological advancements, innovation, and sustainable practices to enhance operational efficiency, reduce environmental impacts, and meet evolving regulatory standards. Additionally, there is growing demand for recycled and secondary sources of precious metals, offering opportunities for recycling companies and scrap processors to extract value from end-of-life products and industrial waste streams. Financial institutions and investment firms can capitalize on the growing demand for precious metal-backed financial products, including ETFs, futures contracts, and digital tokens, to offer investors diversified portfolios and exposure to alternative assets. Moreover, advances in blockchain technology and digitalization present opportunities to enhance transparency, efficiency, and traceability in the precious metal supply chain, addressing concerns related to responsible sourcing and ethical production practices.

Challenges

Despite the opportunities, the global precious metal market faces several challenges that could impact its growth and sustainability. Environmental and social concerns associated with mining activities, including habitat destruction, water pollution, and human rights violations, pose reputational risks and regulatory challenges for mining companies operating in environmentally sensitive regions. Additionally, fluctuations in metal prices, currency exchange rates, and economic conditions can impact the profitability and viability of mining projects, particularly for smaller producers and exploration companies. Moreover, regulatory uncertainties, trade tensions, and geopolitical conflicts can create volatility and uncertainty in the global precious metal market, affecting investor sentiment and market dynamics. Addressing these challenges will require collaboration among governments, industry stakeholders, and civil society to promote responsible mining practices, enhance transparency, and foster sustainable development in the precious metal sector.

Read Also: Multiparameter Patient Monitoring Market Size, Share, Report by 2033

Recent Developments

- In March 2024, together with his family business and longtime colleague Peter Grosskopf, billionaire investor Eric Sprott in precious metal miners and bullion is launching Argo Digital Gold Ltd., a platform that will allow a new generation of investors to own physical gold.

- In July 2023, Barrick Gold disclosed the extension of the mine life for its Tongon gold project in Côte d’Ivoire. This decision comes as a result of the ongoing positive outcomes from gold exploration activities within the Nielle mining permit area.

Precious Metal Market Companies

- Freeport-McMoRan Inc.

- PJSC Polyus.

- Newmont Corporation.

- Gold Fields Limited.

- Randgold & Exploration Company Limited.

- Barrick Gold Corporation.

- AngloGold Ashanti Limited.

- Kinross Gold Corporation.

Segment Covered in the Report

By Product

- Gold

- Silver

- PGM

By Application

- Jewelry

- Industrial

- Investment

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.autoindustrybulletin.com/