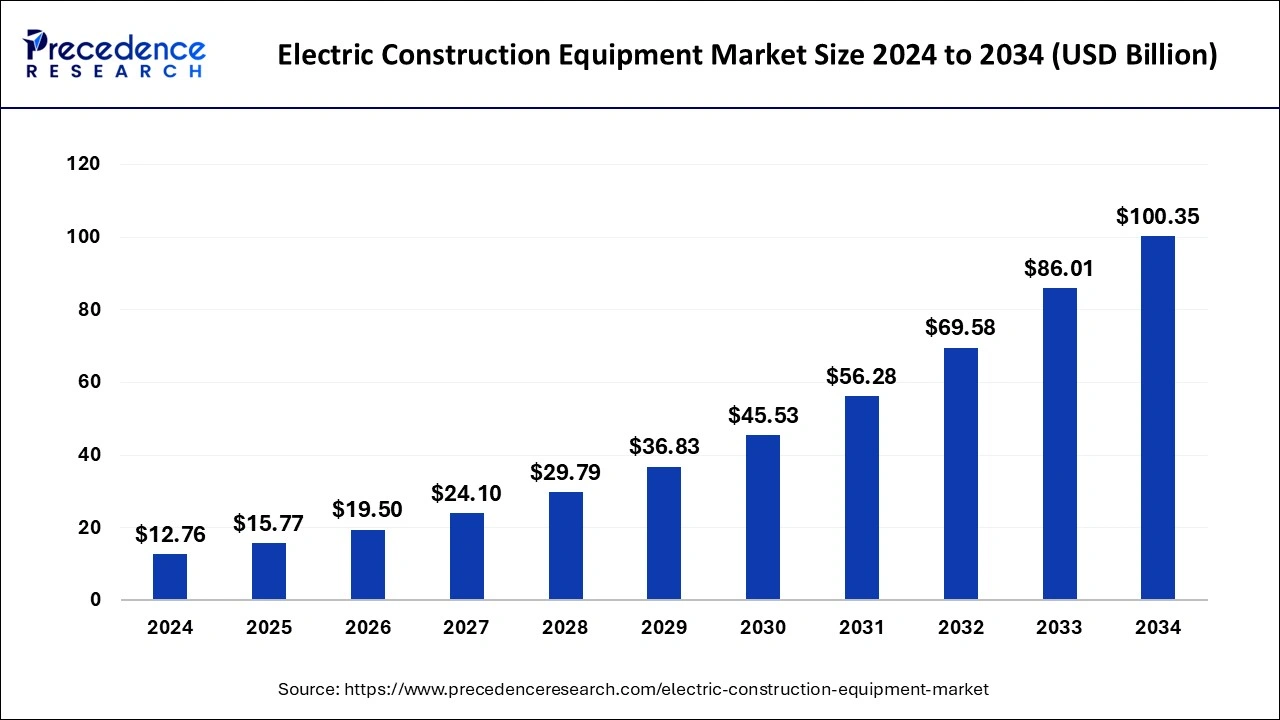

The global electric construction equipment market size was estimated at USD 10.32 billion in 2023 and is predicted to rake around USD 86.01 billion by 2033, growing at a CAGR of 23.62% from 2024 to 2033.

Key Points

- Asia Pacific contributed 34% of market share in 2023.

- North America is estimated to expand the fastest CAGR between 2024 and 2033.

- By vehicles, the excavators segment held the largest market share of 30% in 2023.

- By vehicles, the cranes segment is anticipated to grow at a remarkable CAGR of 25.2% between 2024 and 2033.

- By source, the lithium-ion segment generated over 44% of market share in 2023.

- By source, the lead acid segment is expected to expand at the fastest CAGR over the projected period.

- By end use, the construction segment generated over 32% of market share in 2023.

- By end use, the industrial segment is expected to expand at the fastest CAGR over the projected period.

The global electric construction equipment market is experiencing significant growth as construction companies and equipment manufacturers increasingly transition towards more sustainable and eco-friendly solutions. Electric construction equipment, powered by batteries or alternative energy sources, offers several advantages over traditional diesel-powered machinery, including lower emissions, reduced operating costs, and quieter operation. With growing environmental concerns, stricter emissions regulations, and a shift towards sustainable practices in the construction industry, the demand for electric construction equipment is expected to continue rising in the coming years.

Get a Sample: https://www.precedenceresearch.com/sample/4046

Growth Factors

Several factors are driving the growth of the global electric construction equipment market. Firstly, stringent emissions regulations imposed by governments worldwide are compelling construction companies to adopt cleaner and greener technologies to reduce their environmental footprint. Electric construction equipment, with zero tailpipe emissions, helps companies comply with these regulations while contributing to improved air quality and reduced noise pollution on construction sites. Additionally, advancements in battery technology, such as higher energy density and faster charging capabilities, are making electric construction equipment more viable and cost-effective compared to traditional diesel-powered machinery. Moreover, the lower operating costs associated with electric equipment, including reduced fuel and maintenance expenses, are further incentivizing construction companies to make the switch to electric alternatives.

Electric Construction Equipment Market Data and Statistics

- The European Union has pledged to decrease its net greenhouse gas emissions by a minimum of 55 percent by 2030, compared to levels in 1990. Additionally, as part of the European Climate Law, the EU has set the ambitious target of achieving net zero greenhouse gas emissions by 2050.

- Volvo CE, in June 2023, introduced its inaugural mid-size electric excavator, the EC230 Electric, exclusively within the European market. This initiative aims to provide end-users with solutions that are both low-noise and emissions-free.

- In July 2023, the Brazilian government disclosed plans for a series of road auctions valued at USD 13 billion for the year, aimed at enhancing the maintenance and expansion of the transportation network. This effort seeks to facilitate cross-border trade activities and enhance mobility for consumers.

- A new metro development project, with an estimated investment of Euro 36.1 billion (USD 47.7 billion), has been outlined. The French Government, through Societe du Grand Paris (SGP), is contributing 30% of the funding, with the remaining 70% coming from local authorities through various sources such as taxes, subsidies, and loans.

- Caterpillar announced in November 2023 the initiation of a three-year program aimed at demonstrating an advanced hydrogen-hybrid power solution based on its new Cat C13D engine platform. This endeavor focuses on developing a system capable of meeting transient needs for off-highway applications.

- Volvo Construction Equipment unveiled a 38-tonne class EC380E hybrid excavator model in September 2022, marking one of the largest offerings in the company’s hybrid product line. This launch not only expands Volvo’s hybrid range but also boosts fuel efficiency by 17%.

- India’s government announced its ambition to achieve net zero emissions by 2070 while targeting a reduction of one billion metric tons in projected carbon emissions by 2030. Similarly, China aims to peak CO2 emissions before 2030 and attain carbon neutrality before 2060.

- In June 2023, XCMG, a Chinese heavy machinery manufacturer, launched the XES35, a next-generation super 35m³ electric shovel excavator designed for loading approximately 65 tons of ore per cycle. This excavator is intended for deployment alongside mining dump trucks ranging from 220 to 330 tons.

- The National Highways Authority of India (NHAI) revealed plans in September 2023 to construct 27 new roads in Kerala, with a total project cost of INR 70,114 Crore (USD 8.4 million). These projects will cover a distance of 960.27 km, including the development of greenfield highways and the ongoing construction of National Highway 66.

Region Insights

The adoption of electric construction equipment varies across different regions, influenced by factors such as government policies, infrastructure development, and market dynamics. In regions with stringent emissions regulations and strong environmental initiatives, such as Europe and North America, the demand for electric construction equipment is particularly high. European countries, in particular, have been at the forefront of promoting sustainable construction practices, leading to widespread adoption of electric machinery. Asia-Pacific, driven by rapid urbanization, infrastructure development, and growing awareness of environmental issues, is also witnessing significant growth in the electric construction equipment market, especially in countries like China and India. However, challenges such as limited charging infrastructure and higher upfront costs remain barriers to widespread adoption in certain regions.

Trends

Several trends are shaping the evolution of the electric construction equipment market. One notable trend is the development of all-electric or hybrid electric versions of popular construction equipment, including excavators, loaders, bulldozers, and cranes. Manufacturers are investing in research and development to enhance the performance, efficiency, and durability of electric machinery to meet the demanding requirements of construction projects. Additionally, the integration of smart technologies, telematics, and IoT (Internet of Things) capabilities into electric construction equipment is enabling real-time monitoring, predictive maintenance, and optimization of equipment usage, leading to improved productivity and cost savings for construction companies. Another emerging trend is the collaboration between equipment manufacturers, energy companies, and infrastructure providers to develop comprehensive solutions, including onsite charging stations and renewable energy integration, to support the widespread adoption of electric construction equipment.

Electric Construction Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 23.62% |

| Global Market Size in 2023 | USD 10.32 Billion |

| Global Market Size in 2024 | USD 12.76 Billion |

| Global Market Size by 2033 | USD 86.01 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Vehicles, By Source, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electric Construction Equipment Market Dynamics

Drivers

Several drivers are accelerating the adoption of electric construction equipment globally. Firstly, the desire to reduce carbon emissions and environmental impact is a major driver for construction companies seeking sustainable alternatives to traditional diesel-powered machinery. Electric construction equipment, with its zero-emission operation, helps companies meet sustainability goals and comply with increasingly stringent environmental regulations. Additionally, the potential for cost savings associated with electric equipment, including lower fuel and maintenance costs, presents a compelling economic incentive for construction companies, particularly as energy prices fluctuate and environmental regulations tighten. Moreover, the versatility and performance of electric construction equipment, aided by advancements in battery technology and electric drivetrains, are improving, making electric alternatives increasingly viable for a wide range of construction applications.

Opportunities

The electric construction equipment market offers significant opportunities for stakeholders across the industry value chain. Equipment manufacturers have the opportunity to differentiate themselves and gain a competitive edge by investing in the development of electric machinery with superior performance, efficiency, and reliability. Battery manufacturers can capitalize on the growing demand for high-energy-density batteries tailored for heavy-duty applications, such as construction equipment, by innovating and scaling up production capacity. Infrastructure providers have the opportunity to expand and upgrade charging infrastructure to support the widespread adoption of electric construction equipment, including onsite charging solutions for construction sites and depots. Moreover, governments and regulatory bodies can foster market growth by implementing supportive policies, such as incentives for electric equipment purchases, subsidies for charging infrastructure development, and mandates for emissions reduction in construction projects.

Challenges

Despite the positive momentum, the electric construction equipment market faces several challenges that could impede its growth and adoption. One of the primary challenges is the higher upfront cost of electric equipment compared to traditional diesel-powered machinery, which can be a barrier for small and medium-sized construction companies with limited capital resources. Additionally, concerns about the range and battery life of electric construction equipment, especially for heavy-duty applications, remain significant challenges that need to be addressed through advancements in battery technology and infrastructure development. Moreover, the availability and accessibility of charging infrastructure, particularly in remote or off-grid construction sites, pose challenges for widespread adoption of electric equipment. Addressing these challenges will require collaborative efforts from industry stakeholders, governments, and technology providers to overcome barriers and unlock the full potential of electric construction equipment in driving sustainable and efficient construction practices globally.

Read Also: Carbon Footprint Management Market Size, Share, Report by 2033

Recent Developments

- In 2023, Komatsu achieved significant strides in the electric construction equipment sector. Key releases included the PC05E-1 Electric Micro Excavator, offering zero emissions in Europe for their 3-ton mini excavator range. Additionally, Komatsu introduced the PC200LCE-11 and PC210LCE-11 Electric Excavators, their initial large electric models, promising performance comparable to diesel equivalents but with zero emissions. At CONEXPO 2023, they unveiled the HB365LC-3 Hybrid Excavator, enhancing fuel efficiency and reducing emissions by integrating a diesel engine with an electric motor and battery.

- In June 2022, Cummins and Komatsu signed a memorandum of understanding to collaborate on zero-emission haulage equipment development. Komatsu had previously announced a power-agnostic truck concept in 2021, capable of utilizing various power sources such as diesel-electric, trolley, battery power, and hydrogen fuel cells.

- In the same month of June 2022, John Deere announced a global partnership with Wacker Neuson to develop excavators ranging from 0 to 9 metric tons. Wacker Neuson will manufacture excavators under five metric tons, while John Deere will oversee design, manufacturing, and technology innovation for models between 5 to 9 metric tons.

- In May 2022, Volvo Construction Equipment (Volvo CE) made an investment in Dutch firm Limach, specializing in electric excavators for the domestic market. This investment supports Volvo CE’s long-term electrification strategy and expands its electromobility product range.

- March 2022 saw the joint development showcase of the PC01E-1 by Honda and Komatsu. This electric micro excavator, powered by portable and interchangeable mobile batteries, represents Komatsu’s first foray into electric micro excavators, developed in collaboration with Honda.

- In December 2021, Volvo Construction Equipment (Volvo CE) collaborated with partners across the electric ecosystem to deliver a comprehensive site solution for real urban applications. This project involved machine demonstrations in Gothenburg, supported by entities such as Gothenburg City, NCC, Gothenburg Energy, Lindholmen Science Park, Chalmers University of Technology, and ABB Electrification Sweden, with funding from the Swedish Energy Agency.

- In October 2021, Caterpillar Venture Capital Inc. (Caterpillar) and another venture invested USD 16 million in BrightVolt, Inc. BrightVolt Inc. is renowned for designing, developing, and manufacturing safe, high-energy, low-cost solid-state lithium-ion batteries. This funding aims to advance larger form-factor products catering to industrial electrification and e-mobility markets.

Electric Construction Equipment Market Companies

- Volvo Construction Equipment

- Komatsu

- Caterpillar

- John Deere

- Honda

- Cummins

- Wacker Neuson

- XCMG

- Hitachi Construction Machinery

- Liebherr

- JCB

- Doosan Infracore

- Hyundai Construction Equipment

- Kobelco Construction Machinery

- Sany Group

Segments Covered in the Report

By Vehicles

- Excavators

- Loaders

- Cranes

- Others

By Source

- Lithium-Ion

- Lead Acid

- Others

By End-use

- Residential

- Construction

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/