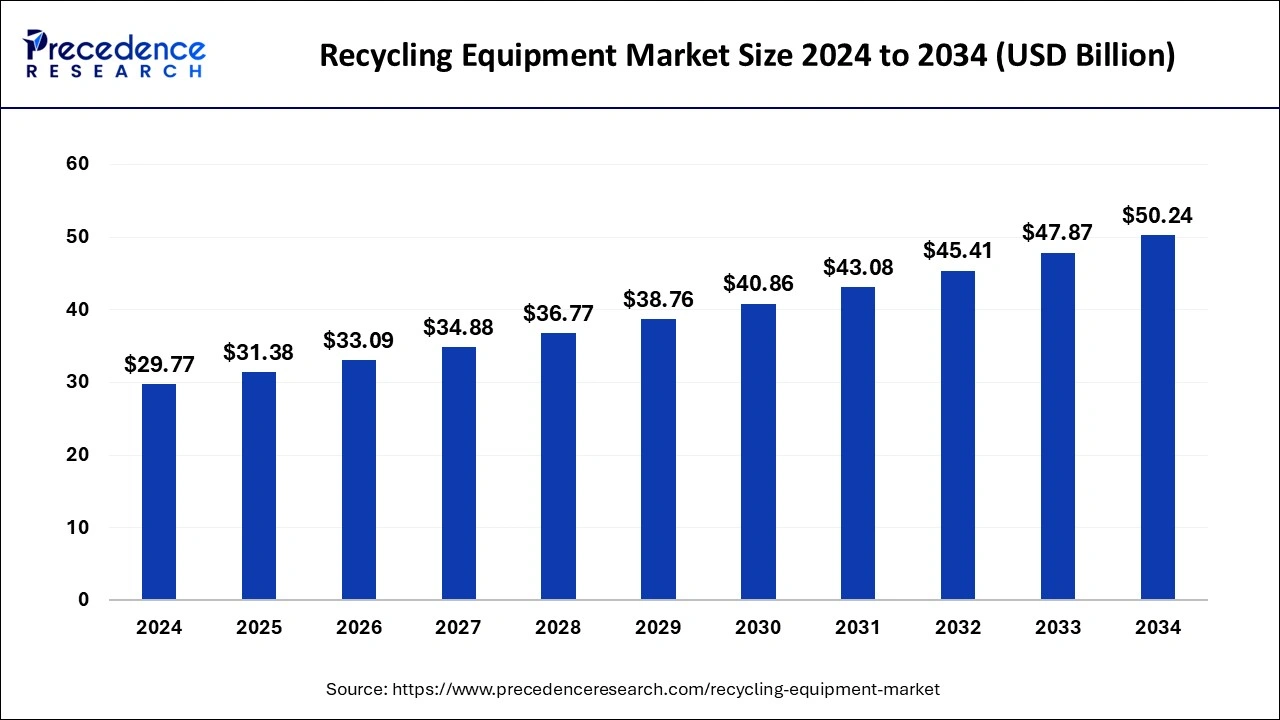

The global recycling equipment market size was excited at USD 28.24 billion in 2023 and is predicted to rise around USD 47.87 billion by 2033, growing at a CAGR of 5.42% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the major market share of 41% in 2023.

- In the North America, the U.S. has recorded for more than 77% of the market share in 2023.

- By equipment, the baler press segment has held the largest market share in 2023.

- By equipment, the separator segment is expected to grow at a significant rate equipment during the forecast period.

- By processed material, the plastic segment has contributed more than 35% of market share in 2023.

- By processed material, the rubber segment is expected to expand rapidly during the forecast period.

The global recycling equipment market is experiencing steady growth driven by increasing environmental concerns, stringent regulations, and a shift towards sustainable practices across industries. This market encompasses a diverse range of equipment used for sorting, processing, and handling recyclable materials such as plastics, metals, paper, and electronic waste. Major players are investing in R&D to develop advanced technologies that improve efficiency and enable higher recycling rates, aligning with global efforts to reduce waste and conserve natural resources.

Get a Sample: https://www.precedenceresearch.com/sample/4246

Growth Factors

Several factors contribute to the growth of the recycling equipment market. Stringent environmental regulations aimed at reducing landfill waste and promoting recycling initiatives are driving demand for recycling equipment. Additionally, growing awareness among consumers and businesses about the benefits of recycling, including cost savings and reduced carbon footprint, is fostering market expansion. Technological advancements such as automation, AI-driven sorting systems, and advanced material recovery techniques are further enhancing the efficiency and effectiveness of recycling processes.

Region Insights

The market for recycling equipment exhibits varying trends across different regions. Developed regions like North America and Europe are leading adopters of recycling technologies, supported by robust waste management infrastructure and favorable government policies. Emerging economies in Asia Pacific, particularly China and India, are witnessing rapid growth in the recycling equipment market due to increasing industrialization and urbanization. Latin America and Africa present untapped potential for market expansion, driven by rising environmental consciousness and growing investments in sustainable development.

Recycling Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.42% |

| Recycling Equipment Market Size in 2023 | USD 28.24 Billion |

| Recycling Equipment Market Size in 2024 | USD 29.77 Billion |

| Recycling Equipment Market Size by 2033 | USD 47.87 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Equipment, and By Processed Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recycling Equipment Market Dynamics

Drivers

Key drivers propelling the recycling equipment market include increasing waste generation coupled with limited landfill capacity, necessitating efficient recycling solutions. Rising public awareness about plastic pollution and the circular economy is accelerating demand for recycling equipment, especially in the packaging and manufacturing sectors. Government initiatives promoting extended producer responsibility (EPR) and waste reduction targets are also stimulating market growth by encouraging investment in recycling infrastructure.

Opportunities

The market offers significant opportunities for innovation and market expansion. Collaborations between equipment manufacturers and recycling companies can lead to the development of customized solutions tailored to specific recycling needs. Expanding into emerging markets with growing industrial activities presents opportunities for market players to establish a strong foothold. Moreover, integrating IoT (Internet of Things) technologies and data analytics into recycling equipment can optimize operations and enhance resource efficiency.

Challenges

Despite positive growth prospects, the recycling equipment market faces challenges such as high initial investment costs associated with advanced recycling technologies. Variability in material composition and contamination levels pose operational challenges for recycling equipment, affecting sorting and processing efficiency. Moreover, global market volatility and trade restrictions on recyclable materials can impact market dynamics and pose logistical challenges for recycling equipment manufacturers and recyclers.

Read Also: Digital Health for Obesity Market Size, Growth, Report By 2033

Recycling Equipment Market Recent Developments

- In February 2024, Lidl launches a city-wide drinks packaging recycling scheme. The launch of the scheme is intended to go some way to preparing customers for Scotland’s nationwide deposit return scheme (DRS) for drinks packaging, which was due to be launched last August but was delayed until March 2024.

- In November 2023, Tomra Recycling Sorting, a business unit of Norway-based Tomra, launched the Innosort Flake for high throughput purification of plastic flakes. The Innosort Flake enables simultaneous flake sorting by color, polymer, and transparency, the company says. “The new Innosort Flake is designed to sort any color, any polymer, at the same time,” says Alberto Piovesan, global segment manager of plastics at Tomra Recycling Sorting. “It levels the playing field for recyclers and gives them maximum flexibility to respond to the respective market demands.

- In August 2023, Genius Machinery announced its highly sophisticated plastic washing recycling machine line. The plastic washing recycling machine line includes rigid washing plants as well as film washing plants. The rigid washing plants are designed to recycle post-consumer hard materials such as bottles, injection molding waste or scrap, pipes, e-waste, and other rigid materials. These systems produce uniform plastic flakes with high purity and low moisture content.

- In October 2022, the EREMA Group company was offering not only previously owned, customized plastics recycling machines but also a new machine that is made to stock and is therefore readily available at short notice. Launched in K 2022, the READYMAC system handles many standard applications in the post-consumer recycling segment and is an attractive option for customers who need a recycling solution on short notice without custom configuration.

Recycling Equipment Market Companies

- Recycling Equipment Manufacturing

- The CP Group

- American Baler

- Kiverco

- General Kinematics

- MHM Recycling Equipment

- Marathon Equipment

- Ceco Equipment Ltd.

- Danieli Centro Recycling

- ELDAN Recycling

- Metso

- Suny Group

- Forrec Srl Recycling

- BHS Sonthofen

- LEFORT GROUP

Segments Covered in the Report

By Equipment

- Baler Press

- Shredders

- Granulators

- Agglomerators

- Shears

- Separators

- Extruders

- Others

By Processed Material

- Metal

- Plastic

- Construction Waste

- Paper

- Rubber

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/