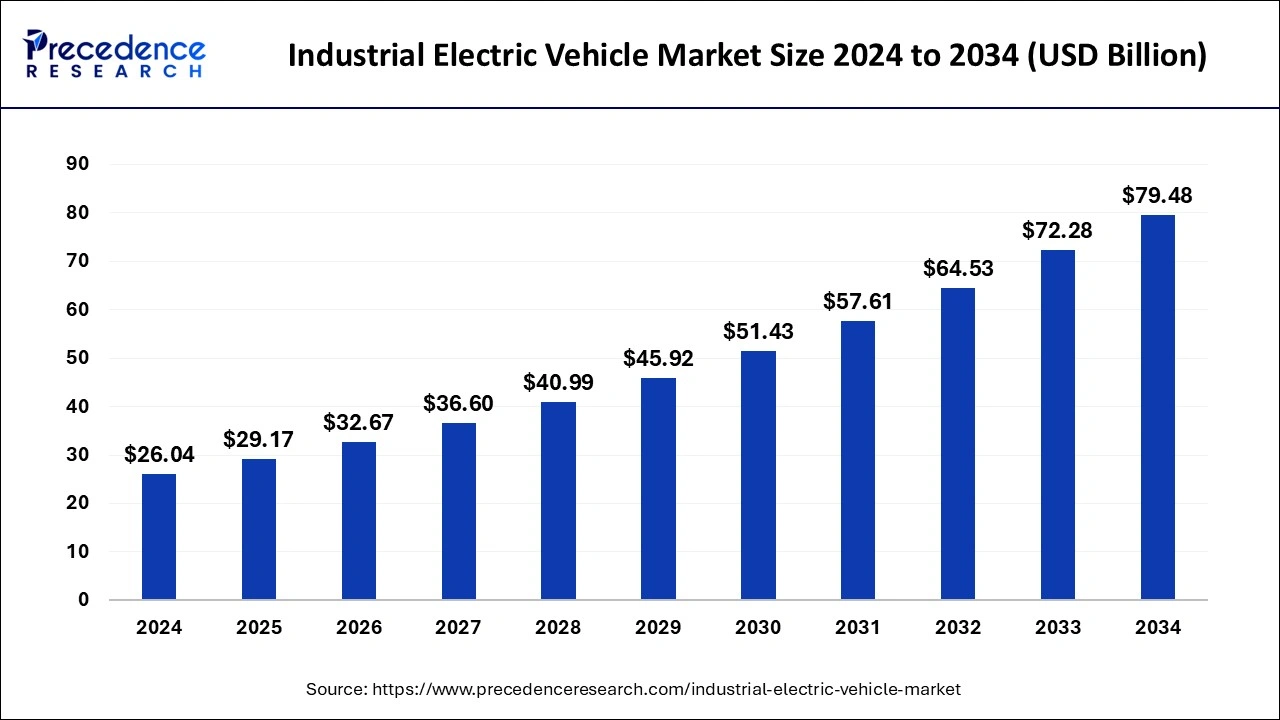

The global electric vehicle market size was calculated at USD 23.25 billion in 2023 and is predicted to rise to around USD 72.28 billion by 2033, expanding at a CAGR of 12.01% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest market share of 41% in 2023.

- North America is expected to witness the fastest growth rate during the forecast period.

- By vehicle, the forklift segment has contributed the major market share of 36% in 2023.

- By propulsion type, the hybrid electric vehicle segment dominated the market in 2023.

- By application, the manufacturing segment has held the largest market share of 41% in 2023.

The industrial electric vehicle market is experiencing rapid growth driven by a combination of factors including increasing environmental regulations, advancements in battery technology, and the growing need for efficient and sustainable transportation solutions in industrial settings. Industrial electric vehicles (IEVs) encompass a range of vehicles such as forklifts, trucks, tractors, and automated guided vehicles (AGVs), which offer advantages like reduced emissions, lower operating costs, and enhanced workplace safety. This market is witnessing significant expansion globally, catering to diverse industries such as manufacturing, logistics, mining, agriculture, and construction.

Get a Sample: https://www.precedenceresearch.com/sample/4247

Growth Factors

The growth of the industrial electric vehicle market is fueled by several key factors. First, stringent environmental regulations and a shift towards sustainability are driving industries to adopt cleaner transportation alternatives. Electric vehicles, powered by electricity rather than fossil fuels, align with these objectives and are increasingly preferred by businesses aiming to reduce their carbon footprint. Additionally, advancements in battery technology, including improved energy density and faster charging capabilities, have enhanced the performance and affordability of electric vehicles, making them more attractive to industrial operators.

Region Insights

The adoption of industrial electric vehicles varies across regions, influenced by factors such as government policies, infrastructure development, and industrial activity. Developed regions like North America and Europe have embraced IEVs more rapidly due to stringent emission standards and government incentives promoting electric vehicle adoption. In Asia Pacific, rapid industrialization and supportive government initiatives have accelerated market growth, with countries like China and India emerging as key markets for industrial electric vehicles.

Industrial Electric Vehicle Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.01% |

| Industrial Electric Vehicle Market Size in 2023 | USD 23.25 Billion |

| Industrial Electric Vehicle Market Size in 2024 | USD 26.04 Billion |

| Industrial Electric Vehicle Market Size by 2033 | USD 72.28 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Vehicle, By Propulsion, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Industrial Electric Vehicle Market Dynamics

Drivers

Several drivers are propelling the growth of the industrial electric vehicle market. Environmental consciousness and the need to comply with emission regulations are compelling industries to transition from traditional internal combustion engine vehicles to electric alternatives. The operational benefits of electric vehicles, including lower maintenance costs, quieter operation, and improved workplace safety, are also driving adoption. Furthermore, the expanding availability of charging infrastructure and ongoing improvements in battery technology are enhancing the feasibility and performance of industrial electric vehicles.

Opportunities

The industrial electric vehicle market presents numerous opportunities for manufacturers and stakeholders. Innovations in electric vehicle technologies tailored for industrial applications, such as heavy-duty trucks and specialized machinery, offer significant growth potential. Collaboration between industry players and technology providers to enhance charging infrastructure and battery efficiency represents another promising opportunity. Additionally, the integration of IoT (Internet of Things) and automation technologies into electric vehicles could unlock new avenues for efficiency and productivity gains in industrial operations.

Challenges

Despite its promising outlook, the industrial electric vehicle market faces certain challenges. One significant hurdle is the initial cost of electric vehicles, which can be higher than conventional counterparts, although declining battery costs and economies of scale are helping to alleviate this challenge. Range limitations and the need for robust charging infrastructure in industrial settings pose logistical challenges that need to be addressed for broader adoption of electric vehicles. Moreover, concerns related to battery recycling and disposal must be addressed to ensure the sustainability of electric vehicles throughout their lifecycle.

Read Also: Recycling Equipment Market Size to Rise USD 47.87 Bn By 2033

Industrial Electric Vehicle Market Recent Developments

- In March 2024, Hyundai Motor India Limited (HMIL) announced that it is planning to launch solution into the Indian electric vehicle market with the development of five latest manufacturing units across the India by 2030.

- In April 2024, the founder of Tesla, Elon Musk stated that he is planning to launch a range of affordable electric vehicle models by the year 2025. Production will start by the second half of 2025.

- In April 2024, Hyundai Motor Group is announcing the launch of the first hybrid cars in India by 2026. As per the reports, the company is currently assessing the hybrid sport-utility vehicle (SUV) similar in size to the bestselling mid-sized Creta SUV.

- In April 2024, Daimler Truck’s, Rizon, a latest brand is proudly announcing the launch of its battery-electric Class 4-5 trucks in Canada. The brand will showcase in Canada for the first time in Truck World in Toronto from April 18th to 20th and will be in the Canadian market with the preorders starts from June 2024.

- In May 2024, Toyota Motor North America, Inc. (Toyota) and FuelCell Energy, Inc. are celebrating the launch of first-of-its-kind “Tri-gen” system at the Port of Long Beach, California. The latest launch Tri-gen uses biogas to renewable hydrogen, produce renewable electricity, and usable water, and designed to support the vehicle distribution and processing center for Toyota Logistics Services (TLS) at Long Beach.

- In May 2024, BorgWarner, the first to the market for the electric torque Vectoring and Disconnect (eTVD) system for battery electric vehicles (BEVs) introduces the Polestar and an additional major European OEM.

- In April 2024, Daimler India Commercial Vehicles (DICV), the branch of the Daimler Truck AG launched the light duty redesigned eCanter all electric in India. It will used as the light duty commercial truck segment.

- In April 2024, Al Masaood Commercial Vehicles & Equipment (CV&E), the part of the well-known business conglomerate Al Masaood Group, announced that they secure the distributorship rights for Dongfeng Commercial Vehicles with the one of China’s premier automotive manufacturers- Dongfeng Automobile Corporation.

Industrial Electric Vehicle Market Companies

- Toyota Industries Corporation

- Hyster-Yale Materials Handling, Inc.

- Balyo

- John Bean Technologies Corporation (JBT)

- Seegrid Corporation

- Kuka AG

- Jungheinrich AG

- Swisslog Holding AG

- Dematic

- Daifuku Co., Ltd.

- Bastian Solutions, Inc.

- Schaefer Holding International GmbH

Segments Covered in the Report

By Vehicle

- Tow Tractors

- Forklifts

- Container Handlers

- Aisle Trucks

- Others

By Propulsion

- Hybrid Electric Vehicles (HEVs)

- Battery Electric Vehicle (BEVs)

By Application

- Manufacturing

- Warehouses

- Freight and Logistics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/