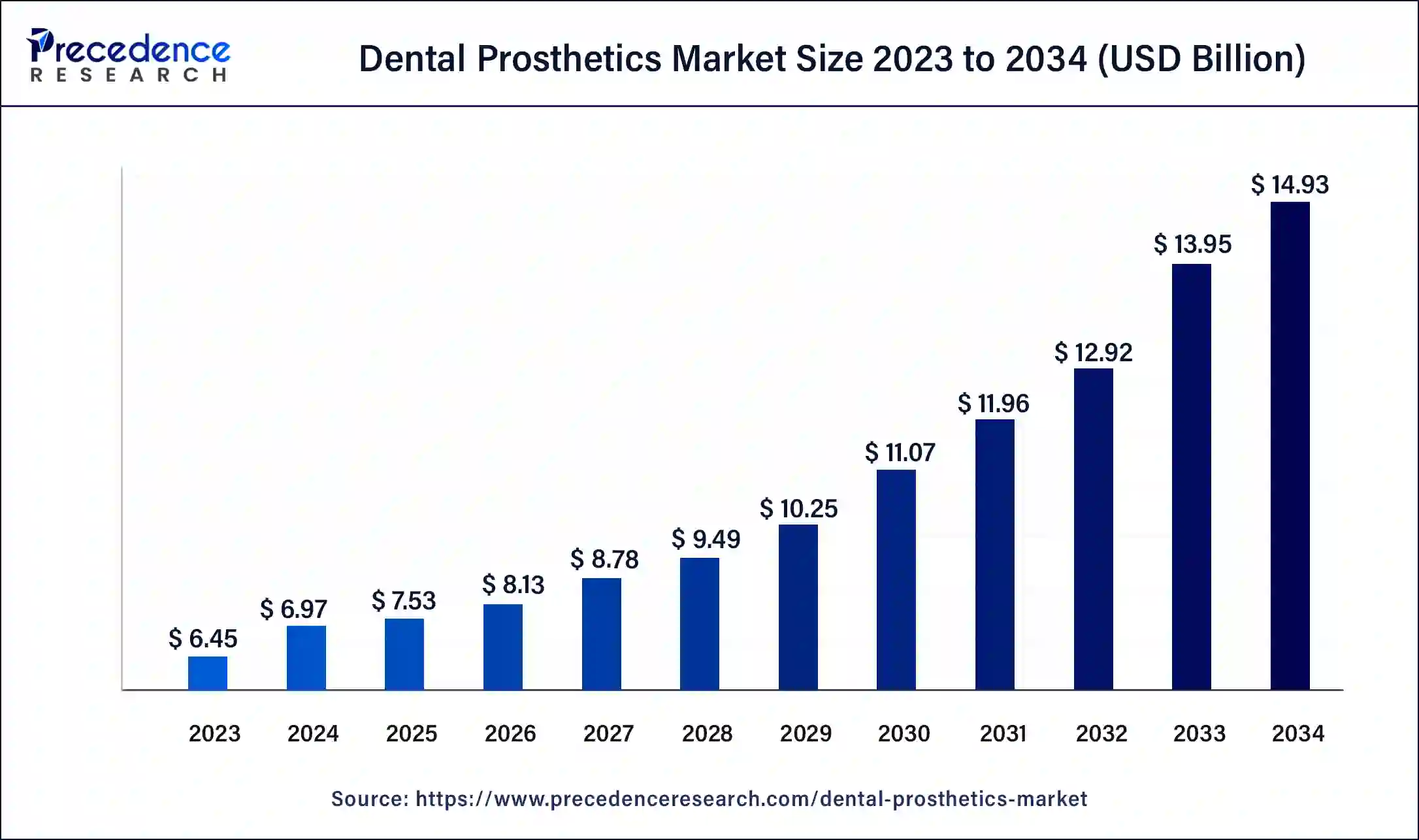

The global dental prosthetics market size was estimated at USD 6.45 billion in 2023 and is predicted to reach around USD 13.95 billion by 2033, growing at a CAGR of 8.02% from 2024 to 2033.

Key Points

- The North America dental prosthetics market size accounted for USD 2.19 billion in 2023 and is expected to attain around USD 4.81 billion by 2033.

- North America has held the largest share of 34% in 2023.

- By region, Asia Pacific is also expected to grow rapidly during the forecast period.

- By type, the fixed dental prosthetic segment has contributed more than 57% of market share in 2023.

- By type, the removable dental prosthetic segment is expected to obtain a significant share of the market during the forecast period.

- By material type, the ceramics segment held a significant share of the market in 2023.

- By end use, the dental hospital & clinics segment held the largest share of the market in 2023 and is expected to maintain its dominance during the forecast period.

- By end use, the dental laboratories are also expected to show significant growth during the forecast period.

The dental prosthetics market encompasses a wide range of devices and materials used to restore oral function and aesthetics for patients with missing or damaged teeth. These prosthetics include crowns, bridges, dentures, implants, and other specialized appliances. The market is driven by factors such as the increasing prevalence of dental disorders, advancements in dental technology, rising demand for cosmetic dentistry, and growing awareness about oral health. Dental prosthetics play a crucial role in improving the quality of life for individuals by restoring their ability to chew, speak, and smile confidently.

Get a Sample: https://www.precedenceresearch.com/sample/4143

Growth Factors:

Several factors contribute to the growth of the dental prosthetics market. Technological advancements have led to the development of innovative materials and techniques, resulting in more durable, comfortable, and aesthetically pleasing prosthetic solutions. Moreover, the aging population worldwide is driving the demand for dental prosthetics, as older adults are more prone to tooth loss and other dental problems. Additionally, the increasing adoption of cosmetic dentistry procedures, fueled by rising disposable incomes and changing societal norms regarding aesthetics, is boosting market growth.

Region Insights: The dental prosthetics market exhibits regional variations influenced by factors such as healthcare infrastructure, economic development, prevalence of dental diseases, and regulatory frameworks. Developed regions like North America and Europe have well-established dental care systems and higher adoption rates of advanced prosthetic solutions. Emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth due to improving healthcare infrastructure, rising disposable incomes, and growing awareness about oral health.

Dental Prosthetics Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.02% |

| Global Market Size in 2023 | USD 6.45 Billion |

| Global Market Size in 2024 | USD 6.97 Billion |

| Global Market Size by 2033 | USD 13.95 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Material Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Dental Prosthetics Market Dynamics

Drivers:

Key drivers of the dental prosthetics market include the increasing incidence of dental disorders such as tooth decay, gum disease, and dental trauma. Moreover, the growing emphasis on preventive dental care and the rise in dental insurance coverage are encouraging more individuals to seek prosthetic treatments. Furthermore, technological innovations, such as digital dentistry and computer-aided design/computer-aided manufacturing (CAD/CAM) technologies, are enhancing the efficiency and accuracy of prosthetic procedures, driving market growth.

Opportunities:

The dental prosthetics market presents several opportunities for growth and expansion. One such opportunity lies in the customization and personalization of prosthetic solutions to meet the unique needs and preferences of individual patients. Additionally, expanding market reach through strategic collaborations, partnerships, and mergers and acquisitions can help companies tap into new geographic markets and target diverse patient populations. Furthermore, ongoing research and development efforts aimed at improving the performance and longevity of dental prosthetics offer promising avenues for innovation and differentiation.

Challenges:

Despite the opportunities, the dental prosthetics market faces challenges such as high treatment costs, particularly for advanced prosthetic procedures like dental implants. Accessibility issues, especially in rural and underserved areas, pose a challenge to market growth, as not all patients have easy access to dental care services. Moreover, regulatory complexities and reimbursement policies vary across regions, adding to the challenges faced by manufacturers and healthcare providers in delivering affordable and high-quality prosthetic solutions to patients. Additionally, patient reluctance or fear of dental procedures and lack of awareness about available treatment options can hinder market expansion efforts.

Read Also: Fluorosurfactant Market Size to Rake USD 1,194.35 Mn by 2033

Dental Prosthetics Market Recent Developments

- In February 2024, Japan saw the launch of TSX® Implant by ZimVie Inc., a leading global life sciences company in the dentistry and spine sectors. Japan is a very important strategic market for ZimVie, being the largest dental implant market in APAC and the sixth largest worldwide. With the introduction of TSX in Japan, the business can now take on premium market leaders in the dental implant industry head-to-head.

- In October 2023, With the release of OnX Tough 2, the first and only 3D printing resin with US Food and Drug Administration (FDA) 510(k) clearance for fixed, implant-supported denture prosthetics, SprintRay, a leader in digital dentistry and dental 3D printing solutions, has taken a significant step forward for the dental industry.

Dental Prosthetics Market Companies

- Institut Straumann AG

- Envista Holdings Corporation

- DENTSPLY Sirona, Inc.

- 3M Company

- ZimVive Inc.

- Henry Schein, Inc.

- Mitsui Chemicals Inc.

Segment Covered in the Report

By Type

- Fixed Dental Prosthetics

- Crowns

- Bridges

- Abutments

- Dentures

- Others

- Removable Dental Prosthetic

- Dentures

- Partial Dentures

- Dental Implants

- Veeners

By Material Type

- Ceramics

- Cement

- Composites

By End-user

- Dental Hospital & Clinics

- Dental Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/