According to a research report “Automotive Suspension Market (By Suspension Type: Macpherson Strut, Multilink Suspension, and Air Suspension; By System Type: Passive Suspension, Semi Active Suspension, and Active Suspension; By Actuation Type: Hydraulically Actuated Suspension and Electronically Actuated Suspension; By Vehicle Type: Passenger Vehicle and Light Commercial Vehicle) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2021 – 2030″ published by Precedence Research.

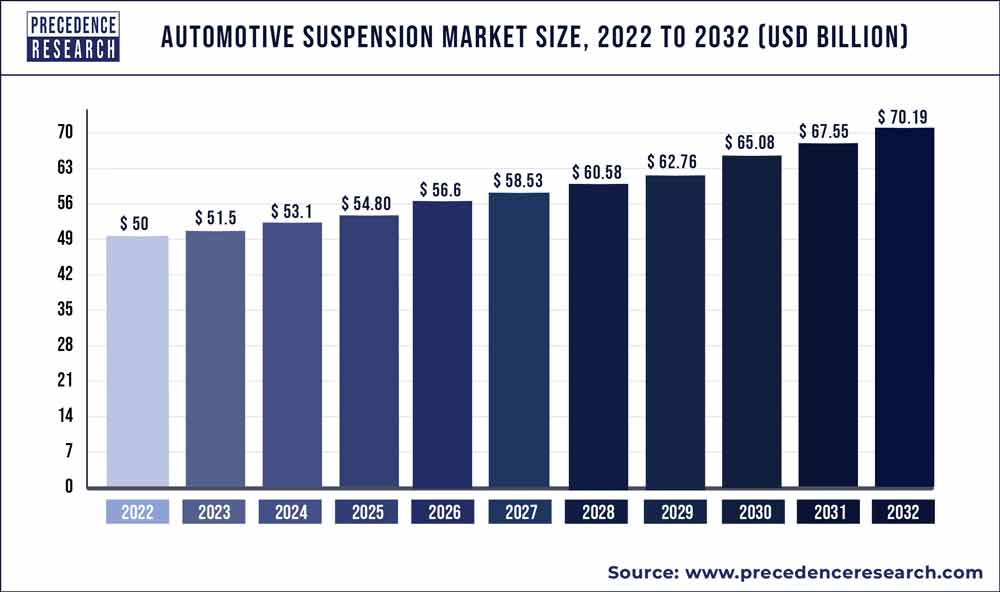

The automotive suspension market size is projected to hit from USD 56.39 billion in 2022 to USD 73.82 billion by 2030, growing at a CAGR of 3.4% every year.

The study provides an analysis of the period 2017-2030, wherein 2021 to 2030 is the forecast period and 2021 is considered as the base year.

The global automotive suspension market is expected to expand significantly during the forecast period. The suspension systems in automobiles are critical components that help to avoid damage to vehicle components while also allowing for safe and comfortable driving. The changing consumer habits, technical developments, and rising urbanization have all aided the automobile industry’s expansion. The suspension systems for automobiles are constantly improving in order to provide a batter ride experience and greater vehicle road holding capabilities.

Get a Free Sample Copy of this Report@ https://www.precedenceresearch.com/sample/1482

The automotive suspension market is likely to be driven by rising vehicle demand in developing regions. In addition, the increased demand for vehicle performance and comfort is likely to drive the market expansion. The lack of standardization and high cost of independent automotive suspension systems may stifle the automotive suspension market growth. The demand for personal automobiles is growing, and independent suspension systems may offer growth potential.

Table of Contents

Scope of the Automotive Suspension Market

| Report Coverage | Details |

| Market Size by 2030 | USD 73.82 Billion |

| Growth Rate from 2021 to 2030 | 3.4% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2021 |

| Forecast Period | 2021 to 2030 |

| Segments Covered | System Type, Region |

Market Dynamics

Drivers

Rise in production of vehicles

Due to their numerous advantages over gasoline-powered vehicles, electric vehicle demand and production have increased dramatically in recent years. Because oil and air filters, fan belts, timing belts, head caskets, and spark plugs do not need to be replaced, fuel-powered vehicles are more cost-effective and efficient. As a result, electric vehicles are rapidly replacing gasoline-powered vehicles as the preferred mode of transportation, limiting the growth of the gasoline-powered vehicle industry. Furthermore, because of improved vehicle dynamics and traction control, automakers are focusing on the development of electric vehicles with the automotive suspension system. As a result, the automotive suspension market is expected to expand due to increased production of electric vehicles.

Restraints

High maintenance costs

The high initial cost of installing new suspension systems raises vehicle prices, which is expected to stymie the growth of the automotive suspension market. The prospect of providing premium features in vehicles incurs additional costs to consumers in the form of hardware, applications, and telecom service charges, limiting market growth. Furthermore, due to the numerous components and sensors, such vehicles are difficult to service and require skilled workers. Vehicle service life is reduced due to the complex structure of systems. As a result, the global automotive suspension market’s growth is expected to be hampered by high initial costs and a complex structure.

Opportunities

Rise in demand for light weight automotive suspension system

The suspension plays an important part in vehicle elegance and comfort, as well as eliminating cabin vibrations. Steel or steel alloys, including stainless steel and carbon steel, are used to create traditional suspension components. These materials, on the other hand, are heavier and have lower strength than other materials. As a result of technological breakthroughs in the automotive industry, automotive lightweight materials such as aluminum, carbon fiber, and titanium alloys have been developed for use in the fabrication of suspension system components. Due to its increased qualities, such as low weight, high specific stiffness, corrosion resistance, capacity to construct complicated geometries, high specific strength, and high impact energy absorption, these materials are utilized to manufacture suspension components.

Read Also: Clinical Communication & Collaboration Market Size to Hit US$ 4.2 Bn by 2030 – Daily Tech Bulletin

Challenges

Lack of standardization

As there will be particular suspension types for each model, the standardization of suspension systems by vehicle type will aid Tier 1 and component manufactures in producing suspension systems in large volumes, lowering overall manufacturing costs. While negotiating supply contracts, original equipment manufacturer (OEMs) and suspension suppliers can develop standardization for independent suspension in terms of key characteristics. For both OEMs and suspension suppliers, this might be a win-win situation. Thus, the lack of standardization is a huge challenge for the growth of automotive suspension market.

Report Highlights

- Based on the suspension type, the MacPherson strut segment dominated the global automotive suspension market in 2020 with highest market share. The MacPherson strut decreases the cost and weight of the architecture by eliminating the need for a separate upper control arm.

- Based on the vehicle type, the passenger vehicle segment is estimated to be the most opportunistic segment during the forecast period. The suspension system is one of the most important components of any vehicle. As a result, the increase of the suspension system is proportional to the volume of passenger vehicles produced.

Regional Snapshot

Asia-Pacific is the largest segment for automotive suspension market in terms of region. This is attributed to an increase in the need for commercial vehicles and improved automobiles and cabs facilities for locals. Also, the expanding population and developing economies of the Asia-Pacific region, which would contribute to the fastest growth of the market.

Europe region is the fastest growing region in the automotive suspension market. This is due to the presence of large number of automobile and components manufacturers. To promote the automotive industry in the Europe, the government entities are developing supportive policies and regulatory frameworks.

Some of the prominent players in the global automotive suspension market include:

- Tenneco Inc.

- Continental AG

- ZF Friedrichschafen AG

- Schaeffler AG

- Sogefi SpA

- Magneti Marelli SpA

- KYB Corporation

- ThyssenKrupp AG

- Mondo Corporation

- BENTELER International AG

Segments Covered in the Report

By Suspension Type

- Macpherson Strut

- Multilink Suspension

- Air Suspension

By System Type

- Passive Suspension

- Semi Active Suspension

- Active Suspension

By Actuation Type

- Hydraulically Actuated Suspension

- Electronically Actuated Suspension

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- MEA

- Rest of the World

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Automotive Suspension Market

5.1. COVID-19 Landscape: Automotive Suspension Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Automotive Suspension Market, By Suspension

8.1. Automotive Suspension Market, by Suspension Type, 2021-2030

8.1.1. Macpherson Strut

8.1.1.1. Market Revenue and Forecast (2019-2030)

8.1.2. Multilink Suspension

8.1.2.1. Market Revenue and Forecast (2019-2030)

8.1.3. Air Suspension

8.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 9. Global Automotive Suspension Market, By System

9.1. Automotive Suspension Market, by System, 2021-2030

9.1.1. Passive Suspension

9.1.1.1. Market Revenue and Forecast (2019-2030)

9.1.2. Semi Active Suspension

9.1.2.1. Market Revenue and Forecast (2019-2030)

9.1.3. Active Suspension

9.1.3.1. Market Revenue and Forecast (2019-2030)

Chapter 10. Global Automotive Suspension Market, By Actuation Type

10.1. Automotive Suspension Market, by Actuation Type, 2021-2030

10.1.1. Hydraulically Actuated Suspension

10.1.1.1. Market Revenue and Forecast (2019-2030)

10.1.2. Electronically Actuated Suspension

10.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 11. Global Automotive Suspension Market, By Vehicle Type

11.1. Automotive Suspension Market, by Vehicle Type, 2021-2030

11.1.1. Passenger Vehicle

11.1.1.1. Market Revenue and Forecast (2019-2030)

11.1.2. Light Commercial Vehicle

11.1.2.1. Market Revenue and Forecast (2019-2030)

Chapter 12. Global Automotive Suspension Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.1.2. Market Revenue and Forecast, by System (2019-2030)

12.1.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.1.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.1.5.2. Market Revenue and Forecast, by System (2019-2030)

12.1.5.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.1.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.1.6.2. Market Revenue and Forecast, by System (2019-2030)

12.1.6.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.1.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.2.2. Market Revenue and Forecast, by System (2019-2030)

12.2.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.2.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.2.5.2. Market Revenue and Forecast, by System (2019-2030)

12.2.5.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.2.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.2.6.2. Market Revenue and Forecast, by System (2019-2030)

12.2.6.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.2.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.2.7.2. Market Revenue and Forecast, by System (2019-2030)

12.2.7.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.2.7.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.2.8.2. Market Revenue and Forecast, by System (2019-2030)

12.2.8.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.2.8.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.3.2. Market Revenue and Forecast, by System (2019-2030)

12.3.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.3.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.3.5.2. Market Revenue and Forecast, by System (2019-2030)

12.3.5.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.3.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.3.6.2. Market Revenue and Forecast, by System (2019-2030)

12.3.6.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.3.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.3.7.2. Market Revenue and Forecast, by System (2019-2030)

12.3.7.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.3.7.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.3.8.2. Market Revenue and Forecast, by System (2019-2030)

12.3.8.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.3.8.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.4.2. Market Revenue and Forecast, by System (2019-2030)

12.4.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.4.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.4.5.2. Market Revenue and Forecast, by System (2019-2030)

12.4.5.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.4.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.4.6.2. Market Revenue and Forecast, by System (2019-2030)

12.4.6.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.4.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.4.7.2. Market Revenue and Forecast, by System (2019-2030)

12.4.7.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.4.7.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.4.8.2. Market Revenue and Forecast, by System (2019-2030)

12.4.8.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.4.8.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.5.2. Market Revenue and Forecast, by System (2019-2030)

12.5.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.5.5.2. Market Revenue and Forecast, by System (2019-2030)

12.5.5.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.5.5.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Suspension (2019-2030)

12.5.6.2. Market Revenue and Forecast, by System (2019-2030)

12.5.6.3. Market Revenue and Forecast, by Actuation Type (2019-2030)

12.5.6.4. Market Revenue and Forecast, by Vehicle Type (2019-2030)

Chapter 13. Company Profiles

13.1. Tenneco Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Continental AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. ZF Friedrichschafen AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Schaeffler AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Sogefi SpA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Magneti Marelli SpA

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. KYB Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. ThyssenKrupp AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Mondo Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. BENTELER International AG

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or the Asia Pacific.

Buy Full Research Report (Single User License US$ 4500) @ https://www.precedenceresearch.com/checkout/1482

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com