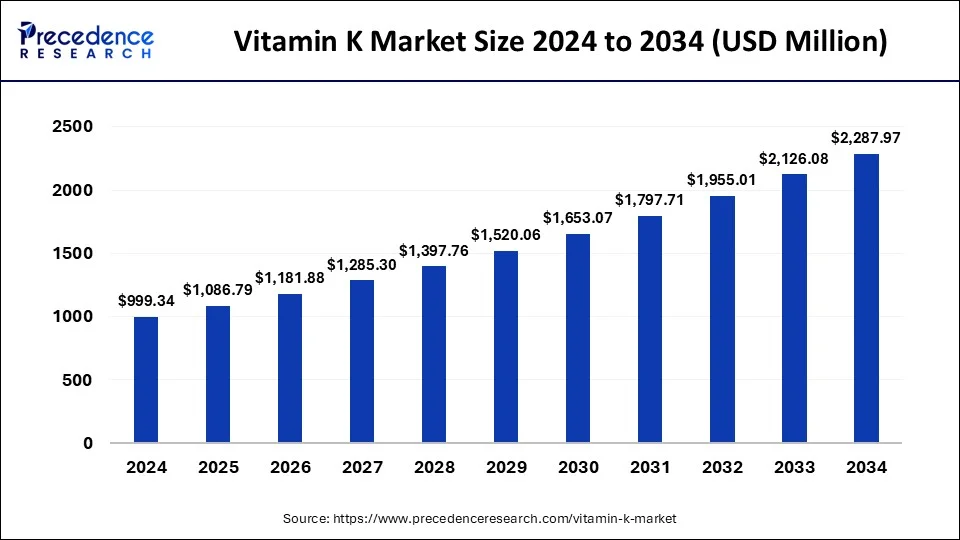

The global vitamin K market size was estimated at USD 918.94 million in 2023 and is projected to grow around USD 2,126.08 million by 2033, growing at a CAGR of 8.75% from 2024 to 2033.

Key Points

- North America held the largest market share of 39% in 2023.

- Asia Pacific is anticipated to witness the fastest rate of growth in the Vitamin K market during the forecast period.

- By product type, the Vitamin K2 segment accounted for a considerable share and is observed to contribute a significant share in the upcoming period.

- By application, the osteoporosis segment held a significant share of the market in 2023.

- By application, the Vitamin K Deficiency Bleeding (VKDB) segment is expected to grow significantly during the forecast period.

- By route of administration, the oral segment led the market with the largest share in 2023.

The global vitamin K market has experienced steady growth in recent years, driven by increasing awareness of its health benefits and rising demand from various end-use industries such as pharmaceuticals, food and beverages, and cosmetics. Vitamin K, comprising vitamin K1 (phylloquinone) and vitamin K2 (menaquinone), plays a crucial role in blood clotting, bone metabolism, and cardiovascular health. As consumers become more health-conscious and seek natural and functional ingredients, the demand for vitamin K supplements and fortified products continues to rise, fueling market growth.

Get a Sample: https://www.precedenceresearch.com/sample/3971

Growth Factors

Several factors contribute to the growth of the global vitamin K market. Firstly, the growing aging population, coupled with rising concerns about bone health and osteoporosis, has led to increased demand for vitamin K supplements and fortified foods. Vitamin K is essential for bone formation and mineralization, making it a vital nutrient for maintaining bone strength and reducing the risk of fractures, particularly among the elderly.

Moreover, the expanding pharmaceutical industry has fueled demand for vitamin K formulations for the treatment and prevention of various medical conditions, including vitamin K deficiency, coagulation disorders, and cardiovascular diseases. Vitamin K supplements are commonly prescribed by healthcare professionals to patients undergoing anticoagulant therapy or those at risk of vitamin K deficiency-related complications.

Additionally, the rising popularity of functional foods and dietary supplements as preventive healthcare measures has boosted the demand for vitamin K-fortified products. Manufacturers are increasingly incorporating vitamin K into a wide range of food and beverage products, including dairy products, cereals, and nutritional supplements, to cater to consumer preferences for natural and functional ingredients.

Furthermore, advancements in vitamin K extraction and purification technologies have improved the efficiency and scalability of production processes, reducing manufacturing costs and expanding market access. Innovative formulations and delivery systems, such as nanoencapsulation and liposomal delivery, enhance the bioavailability and stability of vitamin K supplements, driving consumer acceptance and market growth.

Region Insights:

The demand for vitamin K varies across regions, influenced by factors such as dietary habits, healthcare infrastructure, and regulatory frameworks. North America and Europe are the leading markets for vitamin K, driven by high consumer awareness, strong healthcare systems, and a well-established pharmaceutical and dietary supplement industry. The presence of key market players and extensive research and development activities contribute to market growth in these regions.

Asia Pacific is witnessing significant growth in the vitamin K market, fueled by rising healthcare expenditures, increasing consumer disposable income, and a growing focus on preventive healthcare. Countries such as China, Japan, and India are emerging as key markets for vitamin K supplements and fortified foods, driven by changing dietary patterns and a growing aging population.

Latin America and the Middle East & Africa regions are experiencing moderate growth in the vitamin K market, supported by improving healthcare infrastructure, rising consumer awareness, and the expansion of the pharmaceutical and nutraceutical industries. However, market penetration remains relatively low compared to other regions, presenting opportunities for manufacturers to tap into unmet consumer needs and expand their presence in these markets.

Vitamin K Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.75% |

| Global Market Size in 2023 | USD 918.94 Million |

| Global Market Size by 2033 | USD 2,126.08 Million |

| U.S. Market Size in 2023 | USD 250.87 Million |

| U.S. Market Size by 2033 | USD 580.42 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Route of Administration, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vitamin K Market Dynamics

Drivers:

Several drivers are driving the growth of the global vitamin K market. One of the primary drivers is the increasing prevalence of vitamin K deficiency disorders and related health conditions, such as osteoporosis, cardiovascular diseases, and coagulation disorders. Factors such as poor dietary intake, certain medical conditions, and medication use contribute to vitamin K deficiency, highlighting the need for supplementation and fortification.

Moreover, the growing trend towards preventive healthcare and wellness-oriented lifestyles has led to increased consumer demand for dietary supplements and functional foods containing vitamin K. Consumers are proactively seeking products that offer health benefits beyond basic nutrition, driving the adoption of vitamin K-fortified products as part of their daily diet and wellness routine.

Furthermore, the rise in geriatric population worldwide has heightened awareness of bone health and age-related health issues, driving demand for vitamin K supplements among older adults. Aging populations are more susceptible to vitamin K deficiency and related conditions, creating a significant market opportunity for manufacturers to develop targeted formulations and products catering to this demographic.

Additionally, the expanding pharmaceutical industry and the growing incidence of chronic diseases such as cardiovascular diseases and osteoporosis have increased the demand for vitamin K formulations for therapeutic purposes. Vitamin K supplements are prescribed by healthcare professionals to manage and prevent various medical conditions, driving market growth in the pharmaceutical sector.

Furthermore, advancements in product formulations, delivery systems, and manufacturing technologies have improved the efficacy, safety, and convenience of vitamin K supplements, enhancing consumer acceptance and market penetration. Innovative product formats such as softgels, gummies, and liquid formulations offer consumers a convenient and palatable way to incorporate vitamin K into their daily routine, driving market expansion.

Opportunities:

The global vitamin K market presents several opportunities for growth and expansion. One of the significant opportunities lies in the development of novel formulations and delivery systems that enhance the bioavailability and efficacy of vitamin K supplements. Innovations such as nanoencapsulation, microencapsulation, and liposomal delivery technologies improve nutrient absorption and stability, offering manufacturers a competitive edge in the market.

Moreover, there is growing demand for natural and organic vitamin K products derived from plant-based sources, such as green leafy vegetables and fermented foods. Consumers are increasingly seeking clean label products free from synthetic additives and fillers, driving demand for natural and organic vitamin K supplements and fortified foods.

Additionally, expanding market access through online retail channels and e-commerce platforms presents opportunities for manufacturers to reach a broader consumer base and drive sales growth. The convenience of online shopping, coupled with the availability of a wide range of vitamin K products, appeals to busy consumers seeking convenient and accessible wellness solutions.

Furthermore, strategic partnerships, collaborations, and acquisitions can enable companies to strengthen their market presence, expand distribution networks, and capitalize on emerging market trends. By leveraging synergies and complementary capabilities, manufacturers can accelerate product innovation, enhance brand visibility, and capture new market opportunities.

Moreover, targeting specific consumer segments such as athletes, pregnant women, and individuals with specific health conditions presents opportunities for manufacturers to develop tailored vitamin K formulations catering to unique nutritional needs and preferences. Customized product offerings can help differentiate brands, build consumer loyalty, and drive revenue growth in niche market segments.

Challenges:

Despite the favorable market conditions, the global vitamin K market faces several challenges that may impede growth and market penetration. One of the primary challenges is the lack of awareness and understanding of vitamin K’s health benefits among consumers and healthcare professionals. Limited education and information about vitamin K deficiency disorders, recommended intake levels, and sources of vitamin K may hinder consumer adoption and market growth.

Moreover, regulatory complexities and varying standards for vitamin K supplements and fortified foods across regions pose challenges for manufacturers seeking to expand their product portfolios and enter new markets. Compliance with labeling requirements, quality standards, and safety regulations adds to the cost and complexity of product development and market entry, particularly for small and medium-sized enterprises.

Additionally, concerns about product safety, quality, and efficacy may impact consumer confidence and trust in vitamin K supplements, leading to reluctance to purchase or use these products. Quality control measures, adherence to Good Manufacturing Practices (GMP), and transparency in sourcing and manufacturing processes are essential for building consumer trust and credibility in the market.

Furthermore, pricing pressures and intense competition from generic and private label brands may constrain profit margins and market growth for established players in the vitamin K market. Price sensitivity among consumers, particularly in emerging markets, limits the ability of companies to command premium prices for vitamin K products, necessitating cost optimization strategies and value-added differentiation to remain competitive.

Read Also: Pet Diabetes Care Devices Market Size, Share, Report by 2033

Recent Developments

- In October 2023, Smidge Small Batch Supplements announced the launch of grass-fed, Australian Emu Oil for real food vitamin K2. The company unveiled a new small-batch supplement to their premium, clean line product line that offers essential nutrients lacking in even the best whole foods diet.

- In November 2023, Abbott announced the launch of the new PediaSure with Nutri-Pull System. The Nutri-Pull system is a unique combination of ingredients like vitamin K2, vitamin D, vitamin C, and casein phosphopeptides (CPPs), which help support catch-up growth amongst children through the absorption of key nutrients.

- In June 2022, Balchem Corporation announced the acquisition of vitamin K2 player Kappa Bioscience. Balchem Corporation has signed a definitive agreement to acquire Norwegian Vitamin K2 supplier Kappa Bioscience AS for approximately US$340 million.

Vitamin K Market Companies

- BASF SE

- Lonza Group

- Glanbia Plc

- ADM

- Farbest Brands

- SternVitamin GmbH & Co. K.G.

- Adisseo

- Rabar Pty Ltd

- DSM

- Kappa Bioscience

- Livealth Biopharma

- NattoPharma

- Amphastar Pharmaceuticals Inc.

- NOW Foods

- Pfizer Inc

- Solgar Inc

- Nexeo Solutions

- Kyowa Hakko USA

- Stason Pharmaceuticals

- Asiamerica Ingredients

- Amway

- Bluestar Adisseo Co.

- Atlantic Essential Products Inc.

- Bactolac Pharmaceutical Inc.

Segments Covered in the Report

By Product Type

- Vitamin K1

- Vitamin K2

By Route of Administration

- Oral

- Topical

- Parenteral

By Application

- Osteoporosis

- Vitamin K Dependent Clotting Factor Deficiency (VKCFD)

- Prothrombin deficiency

- Vitamin K Deficiency Bleeding (VKDB)

- Dermal Application

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.autoindustrybulletin.com/