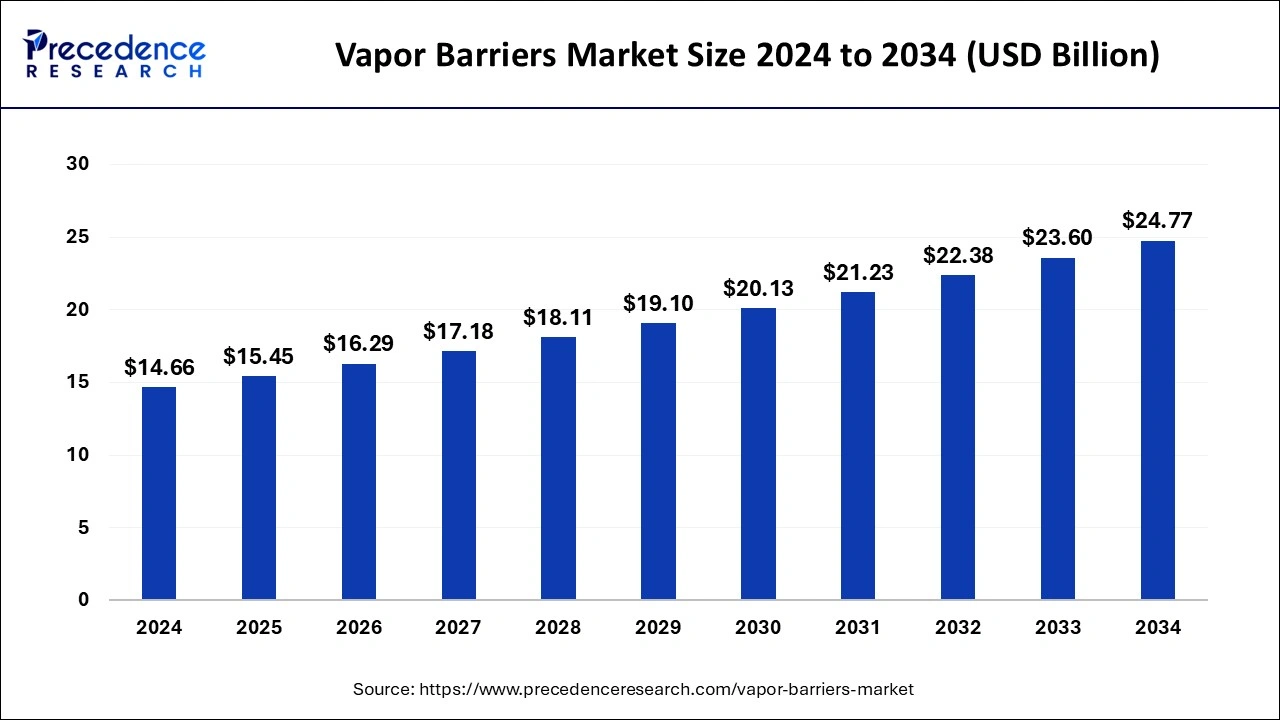

The global vapor barriers market size was estimated at USD 13.90 billion in 2023 and is projected to reach around USD 23.60 billion by 2033, growing at a CAGR of 5.43% from 2024 to 2033.

Key Points

- The North America vapor barriers market size reached USD 5.06 billion in 2023 and is projected to hit around USD 8.59 billion by 2033.

- North America held the dominant share of 36.4% in the vapor barriers market in 2023.

- Asia Pacific is observed to expand at a rapid pace during the forecast period.

- By material, the polymer segment accounted for the dominating share of around 52% in 2023.

- By material, the metal sheet segment is expected to witness a significant share during the forecast period.

- By application, the insulation segment held the largest share of 41% in 2023.

- By installation, the membranes segment held the largest segment of the market in 2023.

- By installation, the cementitious waterproofing segment is expected to grow significantly during the forecast period.

- By end-use industry, the construction segment held the dominating share of the market in 2023.

- By end-use industry, the automotive segment is expected to grow notably.

The vapor barriers market is a rapidly growing segment of the construction and building materials industry. Vapor barriers, also known as vapor retarders, are used to prevent moisture from permeating through walls, floors, and roofs, helping to reduce the risk of mold growth and structural damage. These barriers are essential in ensuring the longevity and safety of buildings, making them a crucial component of modern construction practices.

Get a Sample: https://www.precedenceresearch.com/sample/4107

Growth Factors

The growth of the vapor barriers market is primarily driven by the rising awareness of the importance of moisture control in buildings. This is fueled by increasing concerns about mold-related health issues and the need to protect building materials from water damage. Additionally, stricter building codes and regulations that mandate the use of vapor barriers in construction projects have further propelled market growth.

Region Insights

The North American and European markets dominate the vapor barriers market due to stringent building codes and a high level of construction activity in these regions. The Asia-Pacific region is also witnessing significant growth, attributed to rapid urbanization and infrastructure development in countries such as China and India. Latin America and the Middle East & Africa regions are expected to experience moderate growth, driven by increased investment in construction projects.

Vapor Barriers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.43% |

| Global Market Size in 2023 | USD 13.90 Billion |

| Global Market Size in 2024 | USD 14.66 Billion |

| Global Market Size by 2033 | USD 23.60 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Application, By Installation, and By End-use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Vapor Barriers Market Dynamics

Drivers

Key drivers of the vapor barriers market include the growing demand for energy-efficient buildings and the adoption of sustainable construction practices. The use of vapor barriers helps improve the energy efficiency of buildings by maintaining thermal insulation and preventing heat loss. The increasing focus on green buildings and sustainable construction methods also supports market growth.

Opportunities

The market presents several opportunities for growth, including the development of innovative vapor barrier materials with improved performance characteristics. For instance, advancements in materials science have led to the creation of barriers with enhanced permeability control and durability. The expansion of the construction industry in emerging economies also offers a significant opportunity for market expansion.

Challenges

Despite its growth prospects, the vapor barriers market faces certain challenges. One major challenge is the varying regional regulations and standards regarding the use of vapor barriers, which can create obstacles for manufacturers operating in multiple markets. Additionally, the initial cost of installing vapor barriers may deter some builders and contractors from adopting them, particularly in price-sensitive markets. Nevertheless, the long-term benefits of using vapor barriers often outweigh the initial investment.

Read Also: Urodynamic Equipment and Consumables Market Size, Growth, Report 2033

Recent Developments

- In August 2022, Americover Inc. launched its newest product, the Pro Crawl Anti-Mold Vapor Barrier embedded with Mold Prevention Technology. This product is the second generation of high-performance vapor barriers, which began with the Original Pro Crawl Barrier, designed to reduce vapor transmission in the crawl space significantly.

- In March 2024, Toppan announced the launch of the Indian production of BOPP-based barrier film. Toppan has developed GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP). GL-SP is a new addition to the range of products for sustainable packaging in the Toppan Group’s GL BARRIER1 series of transparent vapor-deposited barrier films, which enjoy a leading share of the global market, according to Toppan. Toppan and TSF have a focus on markets in the Americas, Europe, India, and the ASEAN region.

Vapor Barriers Market Companies

- Glenroy Inc.

- Celplast Metallized Product Ltd.

- Polifilm Group

- ProAmpac Holdings

- Optimum Plastics, Inc.

- 3M Company

- Amcor Limited

- SAES Getters S.p.A.

- Kalliomuovi Oy

- GLT Products

- UFP Industries, Inc.

- W.R. Meadows, Inc.

- BMI Icopal

- Carlisle Companies Inc.

- Reflectix, Inc.

- Layfield Group Ltd.

- Reef Industries, Inc.

- Visqueen Building Product

- RPM International Inc.

- DuPont de Nemours, Inc.

- BASF SE

Segments Covered in the Report

By Material

- Glass

- Metal Sheet

- Polymers

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Others

By Application

- Insulation

- Waterproofing

- Corrosion Resistance

- Others

By Installation

- Membranes

- Coatings

- Cementitious Waterproofing

- Stacking and Filling

By End-use Industry

- Construction

- Packaging

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/