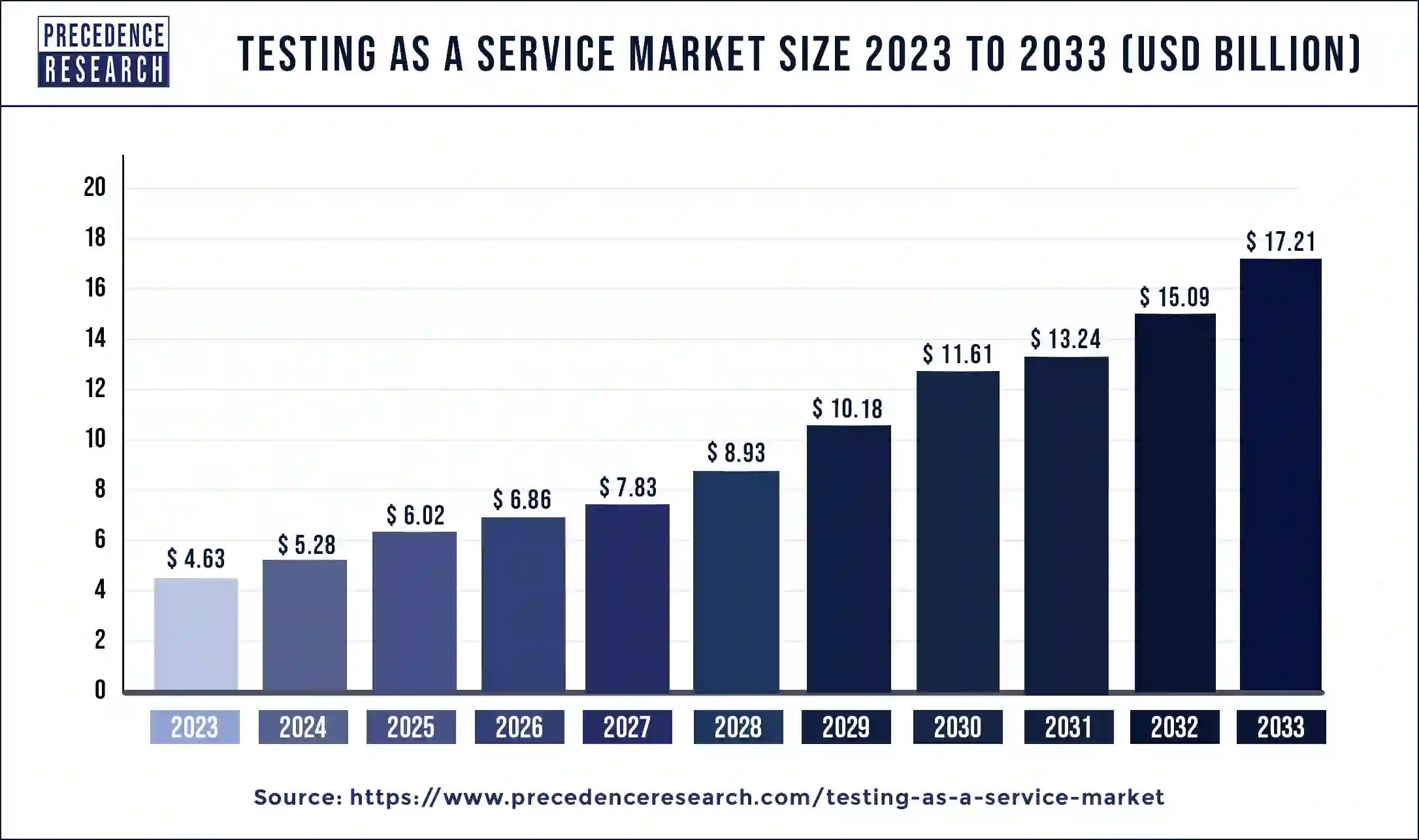

The global testing as a service market size was estimated at USD 4.63 billion in 2023 and is anticipated to hit around USD 17.21 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

Key Points

- North America led the market with holding a 40% of market share in 2023.

- Asia Pacific is expected to witness significant growth during the forecast period.

- By test type, the functionality segment has generated more than 28% of market share in 2023.

- By test type, the security segment is expected to grow the fastest during the forecast period.

- By deployment type, the public segment held a significant share of the market in 2023.

- By deployment type, the private segment is poised to grow at a significant rate during the forecast period.

- By end use, in 2023, the IT & telecommunication segment led the market.

- By end use, the healthcare segment is expected to grow the fastest during the forecast period.

Testing as a Service (TaaS) refers to the outsourcing of software testing activities to a third-party service provider, typically on a pay-per-use or subscription basis. This model allows companies to access specialized testing expertise, tools, and infrastructure without the need for significant upfront investment in resources. The TaaS market has witnessed substantial growth in recent years due to the increasing complexity of software applications, the rising demand for high-quality software, and the need for rapid deployment in agile and DevOps environments.

Get a Sample: https://www.precedenceresearch.com/sample/4043

Growth Factors:

Several factors contribute to the growth of the Testing as a Service market. Firstly, the proliferation of digital transformation initiatives across various industries has led to an increased focus on software quality and reliability. As organizations strive to deliver seamless user experiences across web, mobile, and cloud platforms, the demand for comprehensive testing services has surged. Additionally, the adoption of agile and DevOps methodologies has necessitated continuous testing throughout the software development lifecycle, driving the need for scalable and flexible testing solutions offered by TaaS providers.

Furthermore, the globalization of software development teams and the rise of remote work have created challenges in coordinating testing activities across distributed teams. TaaS offers a solution by providing centralized testing platforms accessible from anywhere, enabling collaboration and seamless integration with development workflows. Moreover, the growing complexity of software ecosystems, including the integration of emerging technologies such as artificial intelligence, Internet of Things (IoT), and blockchain, requires specialized testing expertise that TaaS providers can offer.

Region Insights:

The Testing as a Service market exhibits significant regional variations in terms of adoption, maturity, and market dynamics. North America, led by the United States, dominates the global TaaS market due to the presence of a large number of technology companies, innovative startups, and established enterprises with a strong focus on software quality. The region benefits from advanced infrastructure, a mature IT ecosystem, and a high level of awareness regarding the importance of testing in software development.

Europe is another key region in the TaaS market, characterized by a diverse landscape of industries ranging from automotive and manufacturing to finance and healthcare. Countries such as the United Kingdom, Germany, and France are witnessing increased adoption of TaaS solutions driven by regulatory compliance requirements, digital transformation initiatives, and the need for cost-effective testing solutions. Asia Pacific, particularly emerging economies like India and China, presents significant growth opportunities for TaaS providers due to the rapid expansion of IT outsourcing, burgeoning startup ecosystem, and increasing investment in digital infrastructure.

Testing as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.03% |

| Global Market Size in 2023 | USD 4.63 Billion |

| Global Market Size by 2024 | USD 5.28 Billion |

| Global Market Size by 2033 | USD 17.21 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test Type, By End-use, and By Deployment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Testing as a Service Market Dynamics

Drivers:

Several drivers propel the growth of the Testing as a Service market. One of the primary drivers is the increasing complexity of software applications driven by trends such as cloud computing, mobile technology, and the Internet of Things (IoT). As applications become more intricate and interconnected, traditional testing approaches are no longer sufficient to ensure quality and reliability. TaaS offers specialized testing expertise and tools to address the unique challenges posed by complex software ecosystems.

Additionally, the shift towards agile and DevOps methodologies has accelerated the adoption of TaaS solutions. In agile environments, where software development cycles are short and iterative, continuous testing is essential to ensure rapid delivery without compromising quality. TaaS providers offer automated testing capabilities, on-demand resources, and scalable infrastructure to support continuous integration and delivery pipelines, enabling organizations to accelerate time-to-market and enhance product quality.

Furthermore, the increasing emphasis on cost optimization and resource efficiency is driving organizations to explore outsourcing options for non-core activities such as testing. TaaS offers a cost-effective alternative to in-house testing teams by eliminating the need for upfront investment in testing infrastructure, tools, and personnel. By leveraging TaaS, organizations can access specialized expertise and resources on a pay-per-use basis, reducing capital expenditures and operational costs associated with maintaining an in-house testing infrastructure.

Opportunities:

The Testing as a Service market presents several opportunities for growth and innovation. One such opportunity lies in the expansion of testing services beyond traditional functional testing to encompass emerging areas such as security testing, performance testing, and usability testing. With the increasing frequency and sophistication of cyber threats, security testing has become a critical aspect of software development. TaaS providers can differentiate themselves by offering comprehensive security testing services, including vulnerability assessments, penetration testing, and code reviews.

Moreover, the proliferation of cloud computing and virtualization technologies presents opportunities for TaaS providers to offer cloud-based testing solutions. By leveraging cloud infrastructure, TaaS providers can offer scalable, on-demand testing resources to meet the dynamic needs of modern software development projects. Cloud-based testing platforms also enable collaboration, flexibility, and faster time-to-market by providing access to testing environments from anywhere with an internet connection.

Additionally, the integration of artificial intelligence and machine learning technologies presents opportunities to enhance the efficiency and effectiveness of testing processes. TaaS providers can leverage AI-driven testing tools and analytics to automate test case generation, identify patterns and anomalies, and optimize test coverage. By harnessing the power of AI, TaaS providers can improve the accuracy, speed, and scalability of testing activities, thereby enabling organizations to deliver high-quality software faster and more cost-effectively.

Challenges:

Despite the promising growth prospects, the Testing as a Service market faces several challenges that could impede its expansion. One of the primary challenges is the resistance to change and cultural barriers within organizations. Many companies are accustomed to traditional testing approaches and may be hesitant to adopt TaaS due to concerns about data security, loss of control, and perceived risks associated with outsourcing critical testing activities. Overcoming these barriers requires education, awareness, and effective change management strategies to demonstrate the benefits of TaaS and address stakeholders’ concerns.

Moreover, the fragmented nature of the TaaS market and the proliferation of niche players pose challenges in terms of standardization, interoperability, and vendor selection. With a multitude of TaaS providers offering a diverse range of services and pricing models, organizations may struggle to evaluate and compare offerings effectively. Standardization efforts and industry certifications can help establish benchmarks and best practices for TaaS providers, enabling organizations to make informed decisions and ensure interoperability with existing tools and processes.

Furthermore, ensuring the quality and reliability of TaaS offerings is essential to building trust and credibility with customers. TaaS providers must invest in robust quality assurance processes, rigorous testing methodologies, and continuous improvement initiatives to deliver consistent and reliable testing services. This includes ensuring the security and integrity of testing environments, adhering to industry standards and regulations, and proactively addressing emerging threats and vulnerabilities.

Read Also: Nutraceutical Packaging Market Size to Rise USD 5.86 Bn by 2033

Recent Developments

- In January 2024, Capgemini SE introduced the “CLOUD DE CONFIANCE” platform. This platform provides the specific cloud needs of the French State, public agencies, hospitals, regional authorities, Vital Importance Operators (OIVs), and Essential Service Operators (OSEs), enabling them to use Microsoft 365 and Microsoft Azure services.

- In December 2023, IBM Corporation took over Software AG, a German multinational software corporation. Through this acquisition, IBM would enhance its business portfolio by creating hybrid cloud and cutting-edge AI solutions for enterprises with a distinct and compelling appeal.

- In November 2023, Accenture PLC came into partnership with Vodafone Group Plc, a British multinational telecommunications company. Through this partnership, Accenture PLC would enhance its technology and transformation services business.

- In November 2023, DXC Technology Company entered into a partnership with Amazon Web Services, Inc., an IT Services and IT Consulting company. Through this partnership, DXC Technology Company would expedite the transfer of its fundamental enterprise systems to cloud infrastructure.

Testing as a Service Market Companies

- Accenture

- Atos SE

- Capgemini

- DeviQA Solutions

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- IBM Corporation

- Infosys Limited

- TATA Consultancy Services Limited

- Qualitest Group

Segments Covered in the Report

By Test Type

- Functionality

- Performance

- Compatibility

- Security

- Compliance

- Others

By End-use

- IT & telecommunication

- Healthcare

- BFSI

- Automotive

- Manufacturing

- Retail & Consumer Goods

- Energy & Utilities

- Others

By Deployment Type

- Public

- Private

- Hybrid

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/