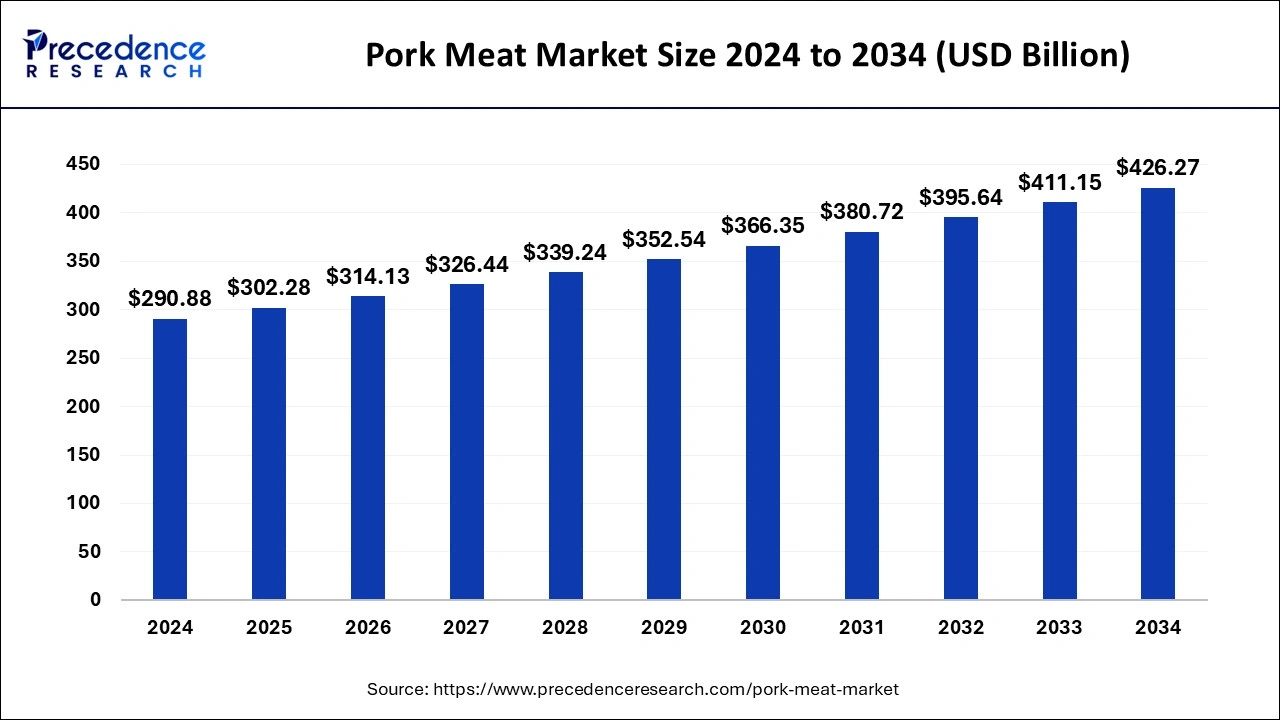

The global pork meat market size reached USD 279.90 billion in 2023 and is predicted to be worth around USD 411.15 billion by 2033, growing at a CAGR of 3.92% from 2024 to 2033.

Key Points

- Asia Pacific was a prominent player in the pork meat market in 2023.

- North America has been witnessing steady growth in the global market.

- By type, the frozen segment emerged as the dominant player in the market in 2023.

- By packaging, the shrink bags segment emerged as the dominant presence in the market in 2023 and is expected to maintain this dominance in the future.

- By application, the commercial segment asserted dominance in the global market in 2023.

The global pork meat market encompasses the production, processing, and distribution of pork products derived from pigs. Pork is one of the most consumed meats worldwide and plays a significant role in various cuisines due to its versatility and relatively lower cost compared to other meats. The market includes fresh pork cuts, processed pork products like bacon, sausages, and ham, as well as by-products such as lard and rendered fats.

Get a Sample: https://www.precedenceresearch.com/sample/4293

Growth Factors:

Several factors contribute to the growth of the pork meat market. Increasing population and rising disposable incomes in emerging economies have led to higher demand for protein-rich food items like pork. Additionally, the versatility of pork in various culinary traditions, combined with its relatively affordable price compared to other meats, continues to drive consumption growth. Technological advancements in meat processing and packaging have also facilitated market expansion by extending shelf life and ensuring product safety.

Region Insights:

The market for pork meat varies significantly by region. Asia-Pacific, particularly China, is the largest consumer and producer of pork globally, accounting for a substantial share of both production and consumption. In North America and Europe, pork consumption is also significant, with a strong demand for processed pork products. Latin America and other emerging markets are witnessing increasing pork consumption due to changing dietary preferences and urbanization.

Pork Meat Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 3.92% |

| Pork Meat Market Size in 2023 | USD 279.90 Billion |

| Pork Meat Market Size in 2024 | USD 290.88 Billion |

| Pork Meat Market Size by 2033 | USD 411.15 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Packaging, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pork Meat Market Dynamics

Drivers:

Several key drivers fuel the pork meat market’s growth. These include the rising demand for animal protein, changing dietary patterns, and the expanding global population. Pork is often favored for its taste and affordability, particularly in regions experiencing economic development and dietary transitions. Furthermore, advancements in breeding techniques and farming practices have increased pork production efficiency, contributing to market growth.

Opportunities:

The pork meat market presents numerous opportunities for expansion. Developing markets offer untapped potential due to increasing disposable incomes and changing food preferences. Diversification of product offerings, including healthier and convenience-focused pork products, can further capitalize on evolving consumer trends. Moreover, exports to international markets present growth opportunities for producers in regions with surplus pork production.

Challenges:

Despite its growth prospects, the pork meat industry faces several challenges. Concerns over animal welfare, environmental impacts of intensive farming, and disease outbreaks such as African Swine Fever (ASF) pose significant risks to production and supply chains. Additionally, shifting consumer preferences towards plant-based diets and alternative protein sources present a challenge to sustained growth in traditional meat markets.

Read Also: U.S. B2B Payments Transaction Market Size, Share, Report by 2033

Pork Meat Market Recent Developments

- In May 2024, German food tech startup MyriaMeat unveiled a cultivated pork fillet made from 100% pork cells without any scaffolds or plant proteins. Months after emerging from stealth, German startup MyriaMeat has announced the successful development of a cultivated pork fillet made entirely from pig cells.

Pork Meat Market Companies

- Danish Crown

- Triumph Foods

- Yurun Group

- Vion Food Group Ltd.

- WH Group

- Smithfield Foods

- JBS S.A.

- Tönnies

- Tyson Foods Inc.

- Shuanghui Development

Segments Covered in the Report

By Type

- Chilled

- Frozen

By Packaging

- Store Wrap

- Modified Atmosphere Packaging

- Vacuum Packaging

- Shrink Bags

- Others

By Application

- Household

- Commercial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/