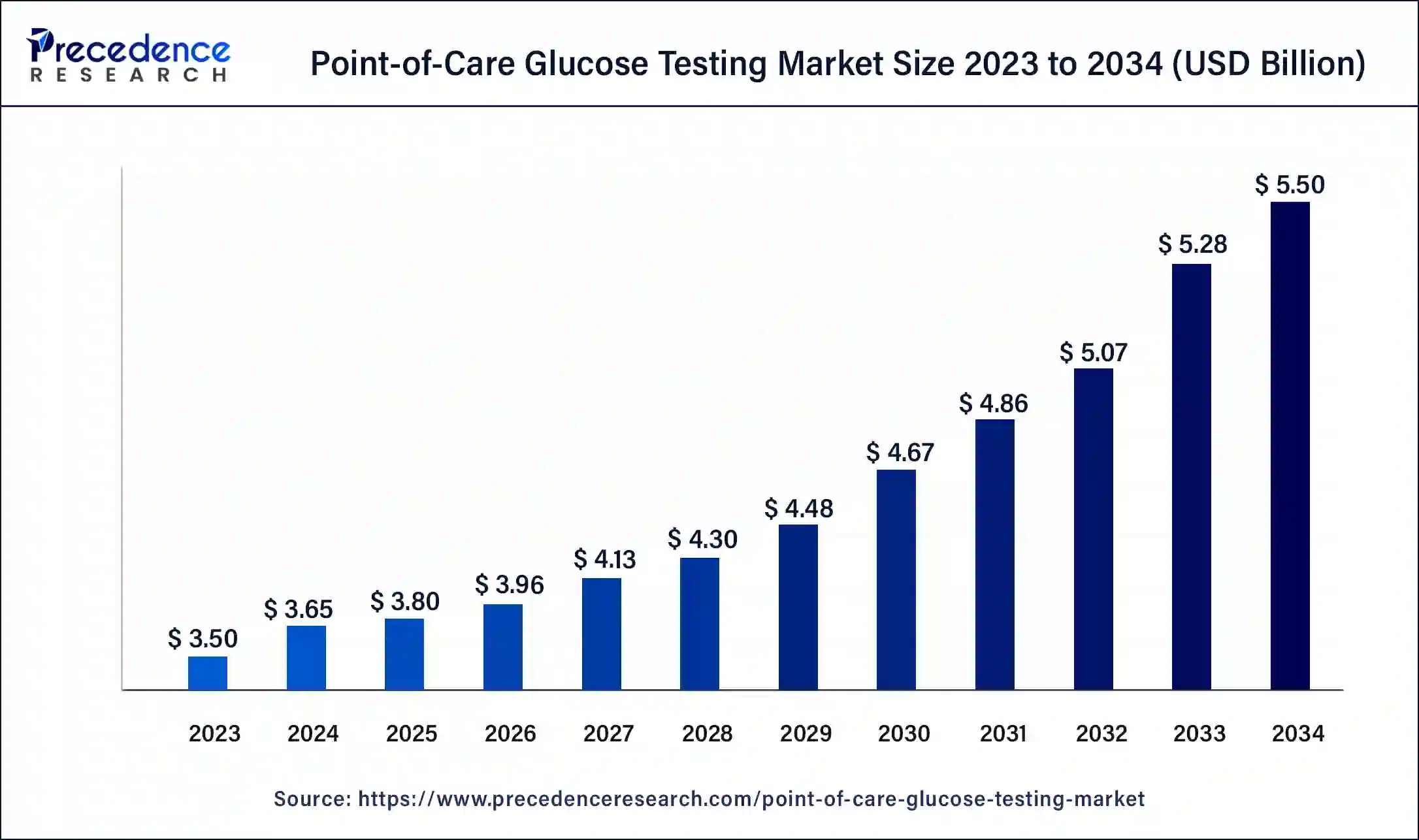

The global point-of-care glucose testing market size was estimated at USD 3.50 billion in 2023 and is predicted to rise around USD 5.20 billion by 2033, growing at a CAGR of 4.03% from 2024 to 2033.

Key Points

- The North America point-of-care glucose testing market size surpassed USD 1.44 billion in 2023 and is expected to be worth around USD 2.13 billion by 2033.

- North America dominated the global point-of-care glucose testing market in 2023 with a revenue share of 41%.

- Asia Pacific is witnessing significant growth in the point-of-care glucose testing market.

- By product, in 2023, the lancing devices and strips segment held the largest share of 63%.

- By application, the type 2 diabetes segment dominated the market in 2023 with a revenue share of 81%.

- By end use, the home care setting segment has accounted revenue share of 62% in 2023.

The point-of-care (POC) glucose testing market refers to the segment of the healthcare industry that deals with medical devices and diagnostic tools used to measure glucose levels in patients’ blood at the point of care. This is typically done in non-laboratory settings such as clinics, doctors’ offices, patients’ homes, or even in emergency settings, allowing healthcare providers to quickly assess a patient’s glucose levels for timely treatment and management.

The market has seen significant growth in recent years due to the increasing prevalence of diabetes worldwide, advancements in technology, and growing demand for portable and easy-to-use devices. These tests are crucial for managing diabetes and preventing complications, as they enable healthcare professionals and patients to monitor and manage blood glucose levels effectively.

Get a Sample: https://www.precedenceresearch.com/sample/4087

Growth Factors

- Increasing Prevalence of Diabetes: One of the primary growth factors in the point-of-care glucose testing market is the rising incidence of diabetes globally. As diabetes becomes more common, the demand for quick and easy glucose testing solutions increases.

- Technological Advancements: Continuous innovations in medical technology have led to the development of more efficient and accurate point-of-care glucose testing devices. These devices offer quick results and ease of use, contributing to market growth.

- Aging Population: An aging population, particularly in developed countries, is more susceptible to diabetes and other chronic conditions. This has led to an increase in the demand for point-of-care glucose testing.

- Home-Based Healthcare: The trend of home-based healthcare and self-management of diabetes has increased the demand for point-of-care glucose testing devices. Patients prefer to monitor their glucose levels at home for convenience.

- Government Initiatives: Government initiatives and policies promoting early diagnosis and management of diabetes have also played a significant role in market growth.

Region Insights

- North America: North America is a leading market for point-of-care glucose testing due to the high prevalence of diabetes in the region, advanced healthcare infrastructure, and high adoption of new technologies.

- Europe: Europe follows closely behind North America in terms of market size, thanks to a growing aging population and strong support for healthcare innovation.

- Asia-Pacific: The Asia-Pacific region is expected to experience significant growth in the point-of-care glucose testing market due to increasing awareness about diabetes, a large patient pool, and rising healthcare expenditure.

- Latin America and the Middle East & Africa: These regions are also expected to witness moderate growth due to improving healthcare infrastructure and an increase in the incidence of diabetes.

Point-of-Care Glucose Testing Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.03% |

| Global Market Size in 2023 | USD 3.50 Billion |

| Global Market Size in 2024 | USD 3.64 Billion |

| Global Market Size by 2033 | USD 5.20 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Point-of-Care Glucose Testing Market Dynamics

Drivers

- Patient Convenience: Point-of-care glucose testing offers patients the convenience of monitoring their blood sugar levels without having to visit a laboratory.

- Rapid Results: Quick test results enable healthcare professionals to provide immediate treatment and management, which is crucial for diabetes control.

- Cost-Effective: In many cases, point-of-care testing can be more cost-effective compared to laboratory testing, especially in resource-limited settings.

- Advancements in Technology: The continuous development of more efficient and user-friendly devices drives market growth.

- Increasing Awareness: Growing awareness about the importance of monitoring blood glucose levels for diabetes management has led to a higher demand for point-of-care glucose testing.

Challenges

- Regulatory Hurdles: Strict regulations and compliance requirements can slow down the introduction of new products in the market.

- Accuracy Concerns: While point-of-care glucose testing is convenient, there can be concerns about the accuracy and consistency of test results compared to laboratory tests.

- Cost of Devices: High costs of point-of-care glucose testing devices may hinder adoption, especially in low-income regions.

- Reimbursement Issues: Reimbursement policies can vary across regions, affecting the adoption of point-of-care glucose testing devices.

- Competition: The market is highly competitive, with several players vying for market share, which can make it challenging for new entrants.

Opportunities

- Emerging Markets: There are significant growth opportunities in emerging markets such as Asia and Africa, where the incidence of diabetes is increasing and healthcare infrastructure is improving.

- Integration with Digital Health: The integration of point-of-care glucose testing with digital health platforms can enhance remote monitoring and management of diabetes.

- Personalized Medicine: As personalized medicine gains traction, point-of-care glucose testing can play a crucial role in tailoring treatments to individual patient needs.

- Expansion of Product Portfolios: Companies can focus on expanding their product portfolios to include a wider range of point-of-care glucose testing devices and accessories.

- Strategic Collaborations: Collaborations with healthcare providers, technology companies, and research institutions can drive innovation and expand market reach.

Read Also: CNC Milling Machines Market Size to Rake USD 113 Bn by 2033

Recent Developments

- In February 2024, Trinity Biotech (TRIB) finalized a conclusive agreement to purchase the biosensor and Continuous Glucose Monitoring (CGM) assets from Waveform Technologies. This strategic acquisition, valued at $12.5 million in cash and 9 million American Depositary Shares (ADSs) of the company, alongside additional considerations, positions Trinity Biotech to innovate diabetes care and upgrade its presence in the biosensor market.

- In July 2023, Avricore Health and Ascensia Diabetes Care revealed a partnership to incorporate blood glucose monitoring into point-of-care testing. The collaboration seeks to integrate the Contour Next-Gen and Contour Next One BGM systems into Avricore’s HealthTab PCOT platform.

- In June 2023, the initial locally produced continuous glucose monitoring device was approved by the South Korean Ministry of Food and Drug Safety. I-SENS, the manufacturer of blood glucose devices, introduced CareSens Air, which claimed to be the most compact and lightweight CGM device accessible in South Korea. It can be utilized continuously for 15 days and incorporates a calibration mechanism to enhance the accuracy of readings.

- In January 2022, Roche introduced the Cobas Pulse, a point-of-care blood glucose monitor meant for hospital personnel, along with a companion gadget structured like a touchscreen smartphone that will run its apps. The Cobas pulse will begin shipping to certain European countries with a CE mark.

Point-of-Care Glucose Testing Market Companies

- Abbott (U.S.)

- Dexcom (U.S.)

- Roche (Switzerland)

- Ascensia Diabetes Care (Switzerland)

- LifeScan (U.S.)

- Medtronic (U.S.)

- Ypsomed (Switzerland)

- Animas (U.S.)

- Insulet (U.S.)

- Bayer (Germany)

- Nipro (Japan)

- Terumo (Japan)

- Arkray (Japan)

- Acon Laboratories (U.S.)

- Freestyle (U.S.)

- One Touch (U.S.)

- Accu-Chek (Germany)

- Dario (U.S.)

- iHealth (China)

- FreeStyle Libre (UK)

Segments Covered in the Report

By Product

- Lancing Devices and Strips

- Blood-Glucose Meter

- Type

- Lifescan OneTouch Ultra and Lifescan OneTouch Verio

- Accu-Chek Aviva Plus and Accuchek

- Freestyle Lite and Freestyle Precission Neo

- Contour Next

- Others

- Type

By Application

- Type-1 Diabetes

- Type-2 Diabetes

By End User

- Hospitals and Clinics

- Home Care Settings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/