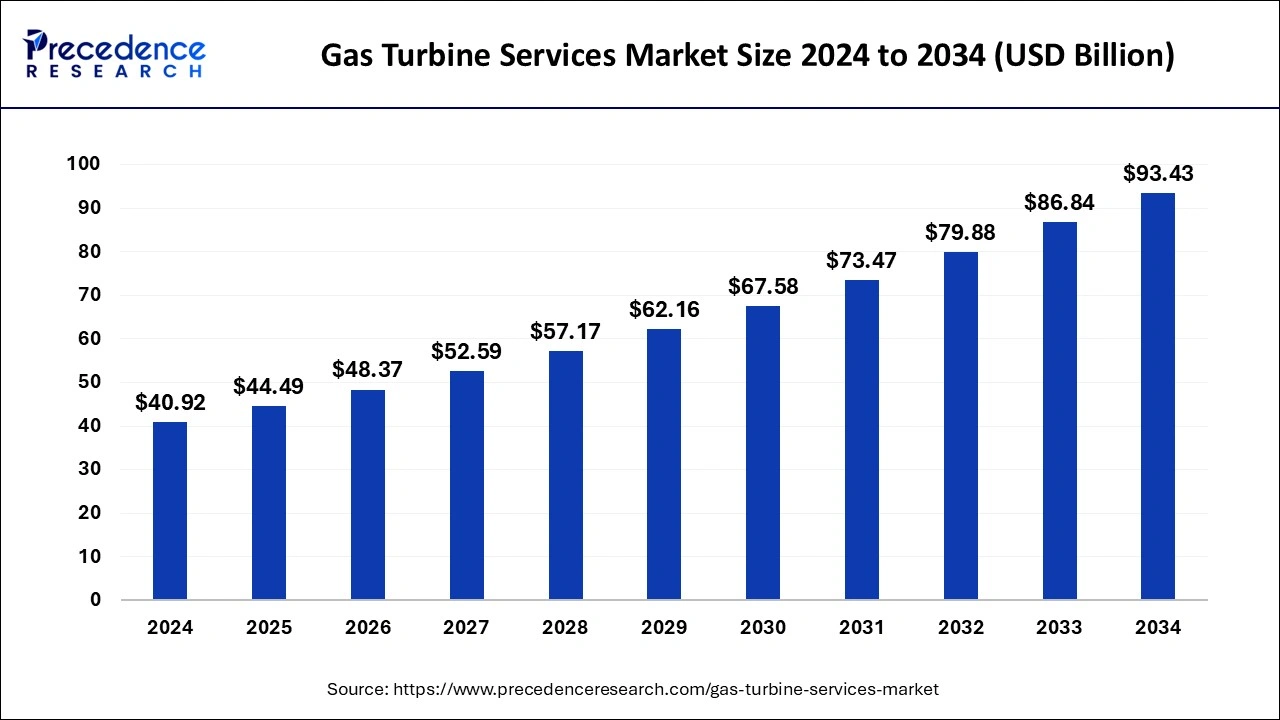

The global gas turbine services market size was estimated at USD 37.64 billion in 2023 and is predicted to reach around USD 86.84 billion by 2033, growing at a CAGR of 8.72% from 2024 to 2033.

Key Points

- Asia Pacific led the market with the largest revenue share of 40% in 2023.

- Europe is expected to hold the fastest-growing market during the forecast period.

- By turbine type, the heavy-duty segment held the largest share of the market in 2023 and is expected to continue doing so during the forecast period.

- By turbine type, the industrial segment is expected to show rapid growth in the market in the upcoming years.

- By turbine capacity, the >200 MW segment has held a major market share of 39% in 2023.

- By turbine capacity, the 100 to 200 MW segment is expected to grow rapidly in the market during the forecast period.

- By service type, the spare parts segment has held the largest revenue share of 64% in 2023.

- By service type, the overhaul segment is expected to grow rapidly in the market during the forecast period.

- By service provider, the OEM segment has contributed more than 62% of revenue share in 2023.

- By service provider, the non-OEM segment is expected to grow rapidly in the market during the forecast period.

- By end use, the power generation segment has recorded more than 69% of revenue share in 2023.

- By end use, the other industries are expected to witness the fastest growth in the market during the forecast period.

The gas turbine services market refers to the provision of maintenance, repair, and overhaul (MRO) services for gas turbines used in various industries such as power generation, oil & gas, and aviation. These services are crucial for ensuring the optimal performance, efficiency, and longevity of gas turbines, which are widely utilized for their reliability and versatility in power generation and mechanical drive applications.

Get a Sample: https://www.precedenceresearch.com/sample/4376

Growth Factors:

The gas turbine services market is expected to witness significant growth due to the increasing demand for electricity worldwide, driven by population growth, urbanization, and industrialization. Additionally, the aging infrastructure of existing gas turbines necessitates regular maintenance and refurbishment, further boosting the demand for gas turbine services. Technological advancements, such as predictive maintenance and digitalization, are also contributing to market growth by enhancing the efficiency and effectiveness of service operations.

Region Insights:

The market for gas turbine services is geographically diverse, with regions such as North America, Europe, Asia Pacific, and the Middle East & Africa witnessing substantial demand. North America and Europe, being early adopters of gas turbine technology, have well-established service industries catering to a large installed base of turbines. In contrast, the Asia Pacific region, particularly countries like China and India, is experiencing rapid industrialization and infrastructure development, driving the need for gas turbine services.

Gas Turbine Services Market Scope

| Report Coverage | Details |

| Gas Turbine Services Market Size in 2023 | USD 37.64 Billion |

| Gas Turbine Services Market Size in 2024 | USD 40.92 Billion |

| Gas Turbine Services Market Size by 2033 | USD 86.84 Billion |

| Gas Turbine Services Market Growth Rate | CAGR of 8.72% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Turbine Type, Turbine Capacity, Service Type, Service Provider, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Gas Turbine Services Market Dynamics

Drivers:

Several factors are driving the growth of the gas turbine services market. These include increasing investments in renewable energy sources, which complement gas turbine installations as part of hybrid power generation systems. Moreover, stringent environmental regulations aimed at reducing emissions are encouraging the adoption of efficient gas turbine technologies and services that help mitigate environmental impact. Additionally, the growing trend of outsourcing maintenance activities by end-users to specialized service providers is fueling market expansion.

Opportunities:

The gas turbine services market presents various opportunities for service providers to capitalize on emerging trends and technologies. Expansion into aftermarket services such as upgrades, retrofits, and life extension programs offers a lucrative opportunity for revenue growth. Furthermore, the adoption of advanced analytics, artificial intelligence, and remote monitoring capabilities enables service providers to offer proactive maintenance solutions, thereby enhancing customer value and competitiveness in the market.

Challenges:

Despite the promising growth prospects, the gas turbine services market faces certain challenges. Economic uncertainties, geopolitical tensions, and fluctuating oil & gas prices can impact investment decisions and project timelines, thereby affecting the demand for gas turbine services. Moreover, the complexity of gas turbine systems and the need for highly skilled workforce pose challenges in terms of service delivery and execution. Additionally, market consolidation and competitive pricing pressure further intensify the challenges faced by service providers.

Read Also: Automatic Door Market Size to Rise USD 42.44 Billion by 2033

Gas Turbine Services Market Recent Developments

- In April 2022, Edra Energy’s 2.2 GW combined cycle power station in Alor Gajah, Malacca, Malaysia, became Malaysia’s largest gas-based power plant. The new plant consists of three generating blocks: a GE 9HA.02 gas turbine, an STF-D650 steam turbine, a W88 generator, and a heat recovery steam generator (HRSG).

- In February 2022, the Mexican Comisión Federal de Electricidad (CFE) awarded a contract to a consortium comprising the Spanish companies Técnicas Reunidas and TSK for the design and construction of combined cycle facilities in Valladolid and Mérida.

Gas Turbine Services Market Companies

- General Electric

- Ansaldo Energia

- MTU Aero engines

- Solr turbines

- Sulzer

- MJB International

Segment Covered in the Report

By Turbine Type

- Heavy Duty

- Industrial

- Aeroderivatives

By Turbine Capacity

- <100 MW

- 100 to 200 MW

- >200 MW

By Service Type

- Maintenance & Repair

- Overhaul

- Spare Parts Supply

By Service Provider

- OEM

- Non-OEM

By End-use

- Power Generation

- Oil & Gas

- Other Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/