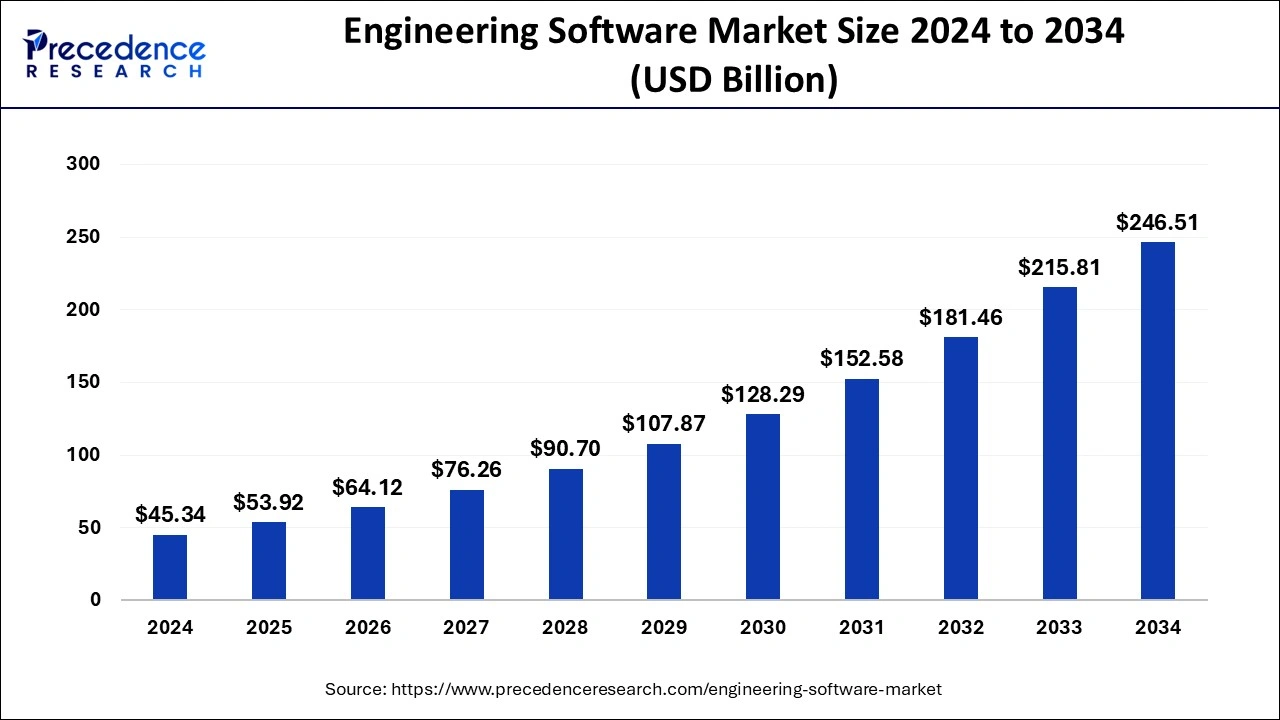

The global engineering software market size was estimated at USD 38.12 billion in 2023 and is projected to grow around USD 215.81 billion by 2033, expanding at a CAGR of 18.93% from 2024 to 2033.

Key Points

- North America has contributed the largest market share of 35% in 2023.

- Asia-Pacific is estimated to expand at the fastest CAGR of 19.4% between 2024 and 2033.

- By component, the software segment has held the largest market share of 71% in 2023.

- By component, the services segment is anticipated to grow at a remarkable CAGR of 19.44% between 2024 and 2033.

- By deployment, the on-premises segment has generated over 54% of market share in 2023.

- By deployment, the cloud segment is expected to grow at the remarkable CAGR of 20.15% over the projected period.

- By application, the product design & testing segment has generated over 32% of market share in 2023.

- By application, the drafting & 3D modeling segment is expected to expand at the fastest CAGR over the projected period.

The Engineering Software Market encompasses a wide range of software solutions tailored to meet the needs of engineers across various industries. This market segment is characterized by the development and deployment of software tools designed to streamline engineering processes, enhance productivity, and facilitate innovation. Engineering software includes CAD (Computer-Aided Design), CAE (Computer-Aided Engineering), CAM (Computer-Aided Manufacturing), PLM (Product Lifecycle Management), and various other specialized tools catering to specific engineering disciplines. With advancements in technology and the increasing demand for efficiency in engineering workflows, the engineering software market has witnessed significant growth and evolution over the years.

Get a Sample: https://www.precedenceresearch.com/sample/4000

Growth Factors:

Several factors contribute to the growth of the Engineering Software Market. Firstly, the rising adoption of digitalization across industries has spurred the demand for software solutions that can automate and optimize engineering tasks. Additionally, the increasing complexity of engineering projects, coupled with the need for faster time-to-market, has driven the uptake of advanced engineering software tools. Moreover, the emergence of technologies such as cloud computing, AI (Artificial Intelligence), and IoT (Internet of Things) has opened up new opportunities for innovation in engineering software, further fueling market growth. Furthermore, the globalization of engineering projects and the need for collaboration among geographically dispersed teams have led to the adoption of collaborative and cloud-based engineering software solutions.

Region Insights

The Engineering Software Market exhibits varying dynamics across different regions. In North America, the market is characterized by the presence of established software vendors and a strong focus on technological innovation. The region benefits from a robust infrastructure and a high concentration of engineering firms across various industries such as aerospace, automotive, and electronics. Europe also holds a significant share of the market, driven by the presence of key players and a strong emphasis on research and development in engineering fields. In Asia Pacific, rapid industrialization and infrastructure development have contributed to the growing demand for engineering software, particularly in countries like China and India.

Engineering Software Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 18.93% |

| Global Market Size in 2023 | USD 38.12 Billion |

| Global Market Size by 2033 | USD 215.81 Billion |

| U.S. Market Size in 2023 | USD 9.34 Billion |

| U.S. Market Size by 2033 | USD 53.25 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Component, By Deployment, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Engineering Software Market Dynamics

Drivers

Several drivers are propelling the growth of the Engineering Software Market. One key driver is the increasing adoption of Building Information Modeling (BIM) software in the construction industry. BIM software enables architects, engineers, and construction professionals to collaborate on building design and construction projects, leading to improved efficiency and cost savings. Another driver is the growing demand for simulation and analysis software in engineering design processes. These tools allow engineers to test and optimize designs virtually, reducing the need for physical prototypes and accelerating time-to-market. Furthermore, the shift towards Industry 4.0 and smart manufacturing has created opportunities for engineering software vendors to provide solutions for digital twin simulation, predictive maintenance, and process optimization.

Opportunities

The Engineering Software Market presents numerous opportunities for vendors and stakeholders. One significant opportunity lies in catering to the growing demand for specialized engineering software solutions tailored to specific industries and applications. For example, there is a rising need for software tools designed for renewable energy projects, additive manufacturing, and autonomous vehicle development. Moreover, as companies increasingly focus on sustainability and environmental stewardship, there is a growing opportunity for engineering software vendors to develop solutions that support green engineering practices and compliance with regulatory standards. Additionally, the expansion of the global engineering workforce presents an opportunity for vendors to provide training and education programs to support skill development and software adoption.

Challenges

Despite the opportunities, the Engineering Software Market also faces several challenges. One challenge is the complexity and interoperability issues associated with integrating different software tools and systems within engineering workflows. Ensuring seamless data exchange and compatibility across platforms remains a significant challenge for both vendors and end-users. Moreover, the high cost of licensing and maintenance fees for advanced engineering software can be a barrier to adoption, particularly for small and medium-sized enterprises (SMEs). Additionally, concerns regarding data security and intellectual property protection pose challenges, especially in industries where confidentiality and regulatory compliance are paramount. Furthermore, the rapid pace of technological change and the need to continuously update and upgrade software solutions present ongoing challenges for vendors in terms of investment and innovation.

Read Also: Artificial Intelligence (AI) in Semiconductor Market Size,Growth, Report 2033

Recent Developments

- In February 2022, Dassault Systèmes and Cadence Design Systems, Inc. revealed a partnership, integrating Dassault Systèmes’ 3DEXPERIENCE platform with the Cadence Allegro platform.

- In November 2022, IBM introduced new tools designed to help companies eliminate data silos and incorporate analytics for making data-driven decisions and swiftly managing unforeseen disruptions. IBM’s Organization Analytics Enterprise provides users with a holistic view of their business’s data sources through features including business intelligence planning, budgeting, reporting, forecasting, and dashboard capabilities.

- Also in November 2022, Bentley Systems launched Bentley Infrastructure Cloud, a suite of business solutions covering the entire infrastructure value chain and lifecycle. Bentley Infrastructure Cloud’s comprehensive and continually updated digital twins enable the creation, delivery, and maintenance of superior infrastructure.

Engineering Software Market Companies

- Autodesk, Inc.

- Siemens Digital Industries Software

- Dassault Systèmes

- ANSYS, Inc.

- Bentley Systems, Incorporated

- Trimble Inc.

- PTC Inc.

- Hexagon AB

- Altair Engineering, Inc.

- MSC Software Corporation

- Synopsys, Inc.

- AVEVA Group plc

- Cadence Design Systems, Inc.

- MathWorks, Inc.

- Aspen Technology, Inc.

Segments Covered in the Report

By Component

- Software

- Computer-Aided Design (CAD) Software

- Computer-Aided Manufacturing (CAM) Software

- Computer-Aided Engineering (CAE) Software

- Others

- Services

- Development Service

- Training, Support & Maintenance

By Deployment

- Cloud

- On-premises

By Application

- Design Automation

- Product Design & Testing

- Plant Design

- Drafting & 3D Modeling

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/