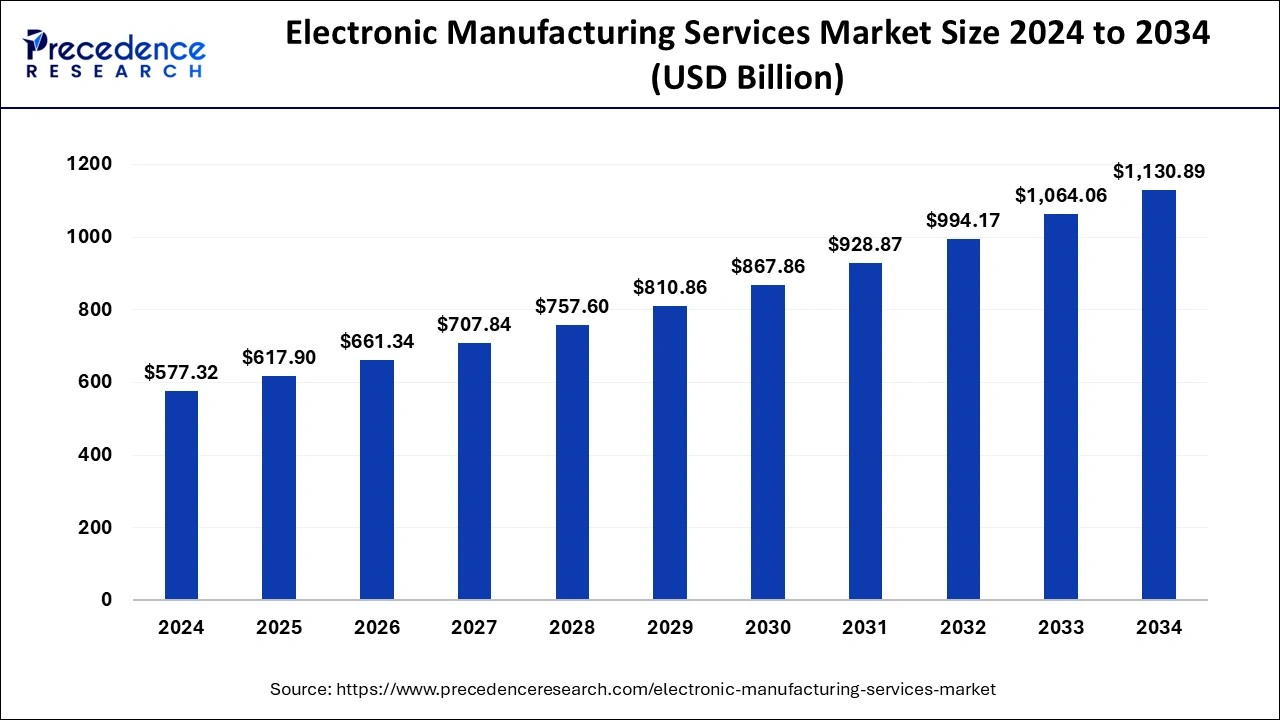

The global electronic manufacturing services market size was exhibited at USD 539.40 billion in 2023 and is predicted to rise around USD 1,064.06 billion by 2033, growing at a CAGR of 7.03% from 2024 to 2033.

Key Points

- Asia Pacific has held the largest market share of 36% in 2023.

- Europe is expected to show significant growth over the forecast period.

- By service type, the engineering services segment dominated the market in 2023.

- By service type, the electronics manufacturing services segment is projected to be the fastest-growing segment over the forecast period.

- By industry type, the IT and telecom segment dominated the market in 2023.

- By industry type, the automotive segment is experiencing notable growth in the market.

The Electronic Manufacturing Services (EMS) market encompasses a wide range of services provided by contract manufacturers to OEMs (Original Equipment Manufacturers) for the production of electronic components, devices, and equipment. EMS providers offer services such as PCB (Printed Circuit Board) assembly, product design, testing, supply chain management, and fulfillment. This industry plays a crucial role in the electronics supply chain by enabling OEMs to outsource manufacturing processes, allowing them to focus on product innovation and market strategy.

Get a Sample: https://www.precedenceresearch.com/sample/4270

Growth Factors

The EMS market is experiencing significant growth driven by several factors. One key driver is the increasing complexity and miniaturization of electronic devices, which require specialized manufacturing capabilities and expertise. Additionally, the rise of IoT (Internet of Things) and connected devices is driving demand for EMS services, particularly in sectors like automotive, healthcare, and consumer electronics. Moreover, cost-efficiency, scalability, and flexibility offered by EMS providers are attracting more OEMs to outsource manufacturing operations.

Regional Insights

The EMS market is globally distributed, with key regions including North America, Europe, Asia Pacific, and Latin America. Asia Pacific dominates the market due to its strong manufacturing base, particularly in countries like China, Taiwan, and South Korea. These regions benefit from lower labor costs, established supply chains, and advanced manufacturing infrastructure. North America and Europe also have a significant presence of EMS providers, serving local and global OEMs.

Electronic Manufacturing Services Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Electronic Manufacturing Services Market Size in 2023 | USD 539.40 Billion |

| Electronic Manufacturing Services Market Size in 2024 | USD 577.32 Billion |

| Electronic Manufacturing Services Market Size by 2033 | USD 1,064.06 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Service Type and By Industry Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronic Manufacturing Services Market Dynamics

Drivers

Several drivers are propelling the growth of the EMS market. One major driver is the increasing demand for electronics across various industries, including consumer electronics, automotive, aerospace, and healthcare. Additionally, rapid technological advancements and the need for quick time-to-market are pushing OEMs to partner with EMS providers to leverage their expertise and resources.

Opportunities

The EMS market presents various opportunities for growth and innovation. Expansion into emerging markets, such as Southeast Asia and Latin America, offers new avenues for EMS providers to diversify their operations and tap into growing demand. Furthermore, the shift towards green manufacturing and sustainable practices creates opportunities for EMS providers to offer eco-friendly solutions and differentiate themselves in the market.

Challenges

Despite its growth prospects, the EMS market faces certain challenges. One key challenge is the volatility in supply chain dynamics, including component shortages and geopolitical factors impacting trade and logistics. Moreover, maintaining quality standards and regulatory compliance across diverse global markets poses operational challenges for EMS providers. Additionally, competitive pressures and margin constraints require EMS companies to continually optimize their operations and invest in technological advancements.

Read Also: Digital Textile Printing Market Size to Rise USD 11.42 Bn by 2033

Electronic Manufacturing Services Market Recent Developments

- In July 2023, Analog Devices, Inc., one of the global semiconductor leaders, and Hon Hai Technology Group (Foxconn), one of the largest global electronics manufacturing services providers, announced the completion of a Memorandum of Understanding (MoU) to develop the next-generation digital car cockpit and a high-performance battery management system (BMS).

- In May 2023, Infineon Technologies AG, one of the global leaders in automotive semiconductors, and Hon Hai Technology Group (Foxconn), one of the largest global electronics manufacturing services providers, aim to establish a partnership in the electric vehicles (EV) field to develop advanced electromobility with efficient and intelligent features jointly. The Memorandum of Understanding (MoU) aims to develop silicon carbide (SiC) and leverage Infineon’s automotive SiC innovations in automotive systems.

- In June 2022, Flex announced the development of its operations in the Mexican state of Jalisco’s automotive sector. The business is building a brand-new, cutting-edge 145,000-square-foot facility that will act as a strategic in-region automotive manufacturing hub to produce advanced electronic components that will hasten the transition to the era of electric and autonomous vehicles.

- In March 2022, Sanmina Corporation (Sanmina), a leading integrated manufacturing solutions company, and Reliance Strategic Business Ventures Limited (RSBVL), a wholly-owned subsidiary of Reliance Industries Limited (RIL), India’s largest private sector company, announced that they have agreed to create a joint venture through investment in Sanmina’s existing Indian entity (Sanmina SCI India Private Ltd, “SIPL”).

Electronic Manufacturing Services Market Companies

- Sanmina Corporation

- Vinatronic Inc.

- Inventec

- Hon Hai Precision Industry Co. Ltd

- Bharat FIH – A Foxconn Technology Group

- SIIX Corporation

- Benchmark Electronics Inc.

- Flex Ltd

- Quanta Computers Inc.

- Osram Opto Semiconductors GmbH

- Kimball Electronics Inc.

- Jabil Inc.

- Celestica Inc.

- Wistron Corporation

- General Electric Company

- Argus Systems

- Plexus Corporation

- Sparton Corporation

- Koninklijke Philips N.V.

- Integrated Microelectronics Inc

Segments Covered in the Report

By Service Type

- Electronics Manufacturing

- Engineering Services

- Test & Development Implementation

- Logistics Services

- Others

By Industry Type

- Computer

- Consumer Electronics

- Aerospace & Defense

- Medical & Healthcare

- IT & Telecom

- Automotive

- Semiconductor Manufacturing

- Robotics

- Heavy Industrial Manufacturing

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/