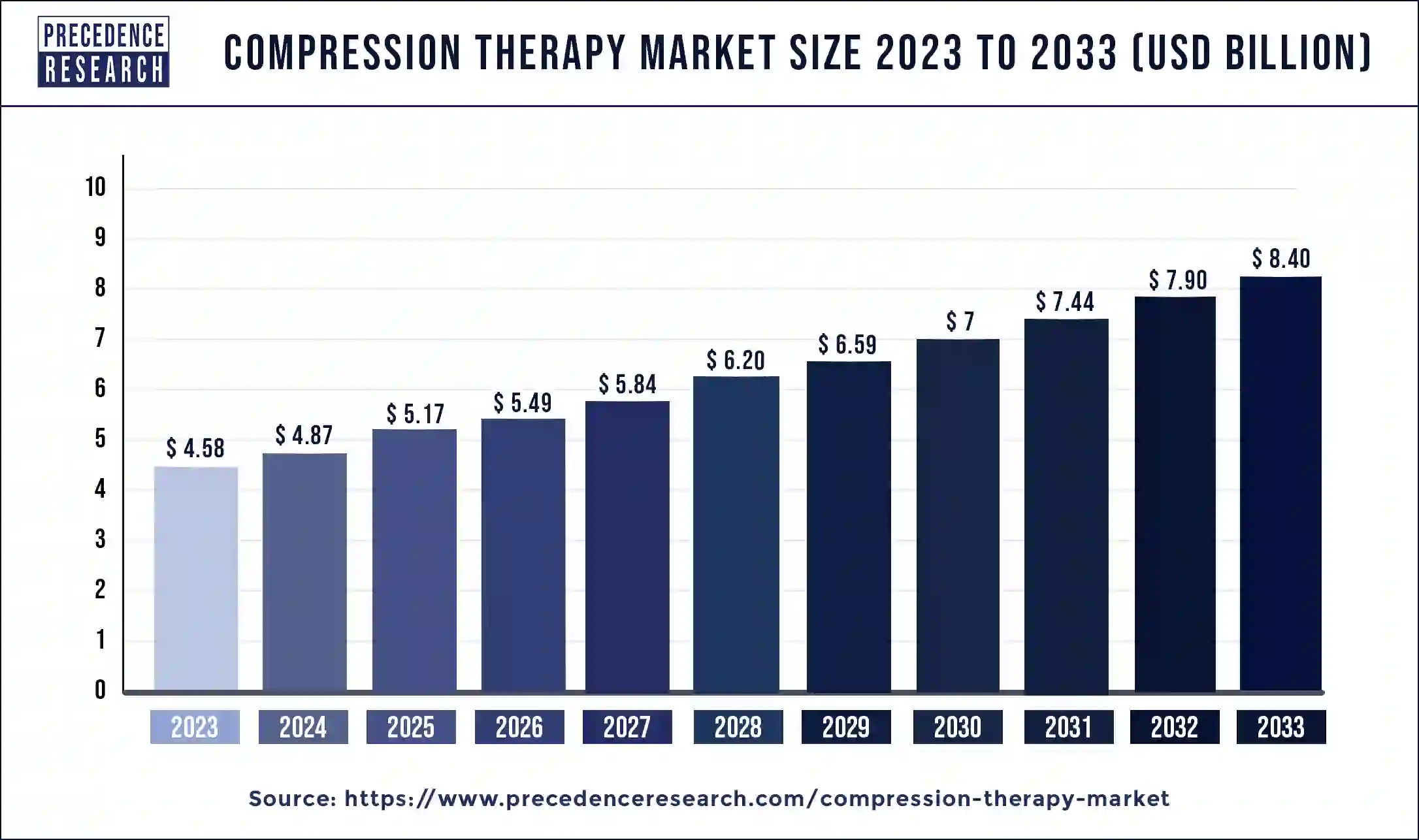

The global compression therapy market size was estimated at USD 4.58 billion in 2023 and is projected to rake around USD 8.40 billion by 2033 with a CAGR of 6.25% from 2024 to 2033.

Key Points

- North America dominated the market with the major market share of 44% in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By product, the compression bandages segment has accounted for the largest market share of 44% in 2023.

- By product, the compression pumps segment is expected to witness the fastest rate of growth during the forecast period.

- By technology, the static technology segment held the biggest market share of 66% in 2023.

- By technology, the dynamic technology segment is expected to grow at a significant rate during the forecast period.

The compression therapy market is witnessing substantial growth globally, driven by the increasing prevalence of vascular diseases and the expanding aging population. Compression therapy involves the use of specially designed garments or devices to apply controlled pressure on specific body parts, such as the legs or arms. This therapy is widely used to manage various medical conditions, including venous disorders, lymphedema, and deep vein thrombosis. The rising awareness about the benefits of compression therapy, coupled with advancements in technology, is contributing to the market’s expansion.

Get a Sample: https://www.precedenceresearch.com/sample/3934

Growth Factors

Several factors contribute to the robust growth of the compression therapy market. Firstly, the rising incidence of chronic diseases, such as diabetes and obesity, is leading to an upsurge in vascular disorders, fueling the demand for compression therapy. Additionally, advancements in compression therapy products, including innovative materials and improved designs, enhance patient comfort and compliance, further boosting market growth. Moreover, the growing geriatric population, prone to venous and lymphatic diseases, is a significant demographic driver for the compression therapy market.

Region Insights:

The compression therapy market exhibits regional variations driven by healthcare infrastructure, economic factors, and demographic trends. North America holds a substantial share, attributed to the high prevalence of vascular diseases and a well-established healthcare system. In Europe, increasing awareness and favorable reimbursement policies contribute to market growth. Asia-Pacific is emerging as a lucrative market, propelled by a growing aging population and rising healthcare expenditures.

Compression Therapy Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.25% |

| Global Market Size in 2023 | USD 4.58 Billion |

| Global Market Size by 2033 | USD 8.40 Billion |

| U.S. Market Size in 2023 | USD 1.51 Billion |

| U.S. Market Size by 2033 | USD 2.77 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Compression Therapy Market Dynamics

Drivers:

The primary drivers for the compression therapy market include the increasing incidence of chronic diseases, rising healthcare awareness, and the growing aging population. Technological advancements, such as the development of smart compression garments and wearable devices, are driving innovation in the market. Additionally, proactive government initiatives to address the burden of venous diseases are creating a conducive environment for market growth.

Restraints:

Despite its positive trajectory, the compression therapy market faces certain challenges. Limited awareness among patients and healthcare professionals about the benefits of compression therapy remains a significant restraint. Moreover, the high cost of advanced compression therapy products may hinder market penetration, particularly in developing regions. Issues related to discomfort and adherence to therapy regimes also pose challenges to the widespread adoption of compression therapy.

Opportunities:

The compression therapy market presents ample opportunities for growth and innovation. Increasing research and development activities are likely to lead to the introduction of more effective and patient-friendly compression products. Collaborations between healthcare providers and manufacturers can enhance awareness and drive market expansion. Furthermore, the untapped potential in emerging markets provides an opportunity for industry players to diversify and broaden their market presence.

Read Also: Cannabidiol Market Size to Grow USD 35.96 Billion by 2033

Recent Developments

- In May 2020, AIROS Medical, Inc., a medical technology manufacturer specializing in compression therapy products that treat cancer-related lymphedema and venous complications, announced the launch of its updated AIROS 6 Sequential Compression Therapy device and Arm Plus garments following multiple regulatory approvals.

- In June 2022, Stryker has launched a new research & development facility in India, covering an extensive area of 150,000 square feet. The facility’s primary objective is to foster innovation within India and on a global scale, reinforcing the company’s commitment to enhancing healthcare worldwide.

- In February 2022, Therabody unveiled its latest product, the second generation of Recovery Air pneumatic compression boots. These boots feature cutting-edge technology, enabling more efficient post-recovery for users. With advanced pneumatic compression, the boots aid in improving blood circulation and reducing muscle soreness and swelling, ensuring an effective and accelerated recovery process for individuals.

- In September 2021, Arjo announced that it has received 510(k) clearance from the US Food and Drug Administration (FDA) for WoundExpress, an intermittent pneumatic compression (IPC) solution for accelerating healing of venous leg ulcers. The FDA clearance follows several recent studies showing that WoundExpress can significantly improve lower leg wound management.

- in January 2022, AIROS Medical, Inc., a designer, manufacturer, and distributor of compression therapy devices, and Fist Assist Devices, LLC (Fist Assist), an innovative medical device company, launched an e-commerce website, www.fistassistusa.com, for the sale of the Fist Assist FA-1 compression device in the United States. This will increase sales of compression therapies via online platforms, driving market growth in this region.

Compression Therapy Market Companies

- Smith & Nephew PLC

- Medline Industries, Inc.

- Cardinal Health

- Julius Zorn GmbH

- Hartmann AG

- Medi GmbH & Co.

- SIGVARIS

- BSN Medical GmbH

- Convatec Group PLC

- Bio Compression Systems, Inc.

- Stryker

- Arjo

- Tactile Medical

- Gottfried Medical

- 3M Company

- Paul Hartmann

- DJO Global, Inc.

- Juzo

- Spectrum Healthcare

Segments Covered in the Report

By Product

- Compression Pumps

- Compression Stockings

- Compression Bandages

- Compression Tape

By Technology

- Static Compression Therapy

- Dynamic Compression Therapy

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/