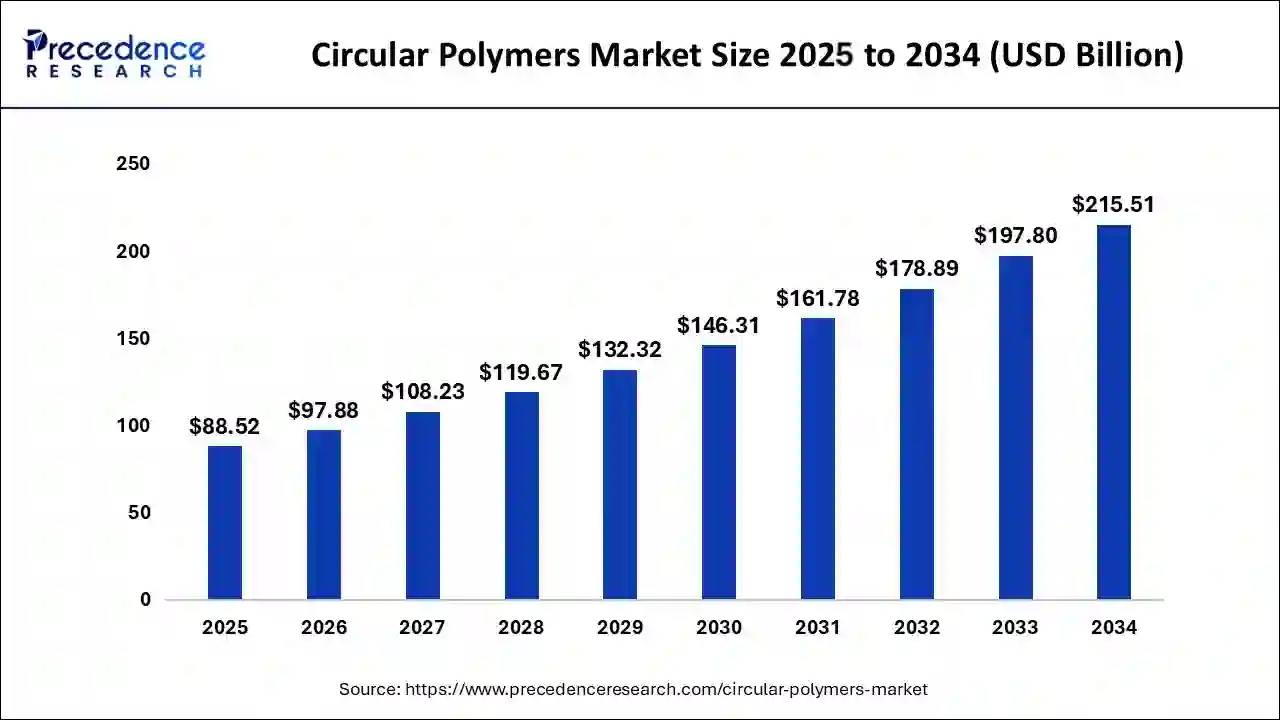

The global circular polymers market size was estimated at USD 72.40 billion in 2023 and is predicted to reach around USD 197.80 billion by 2033, growing at a CAGR of 10.57% from 2024 to 2033.

Key Points

- In 2023, Asia Pacific dominated the circular polymers market with a market share of 47%.

- North America is expected to secure a significant portion of the market’s revenue in the upcoming years.

- By polymer type, the polyethylene (PE) segment has dominated the market in 2023 with a market share of 33%.

- By form, in 2023, the pellets segment has accounted largest market share of around 54%.

- By form, the flakes segment has captured a market share of around 46% in 2023.

- By application, the food packaging segment dominated the market of circular polymers in 2023 with a 44% revenue share.

- By end use, the packaging segment captured a market share of 54% in 2023.

The Circular Polymers Market is witnessing significant growth driven by increasing environmental concerns and the need for sustainable solutions. Circular polymers, derived from recycled materials, offer a closed-loop approach to plastics, reducing waste and minimizing the reliance on virgin resources. This market encompasses a wide range of polymer types, including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and others, catering to various industries such as packaging, automotive, construction, and textiles.

Get a Sample:https://www.precedenceresearch.com/sample/4092

Growth Factors:

The growth of the Circular Polymers Market is fueled by several key factors. Government regulations promoting recycling and sustainability initiatives play a crucial role in driving the adoption of circular polymers. Additionally, increasing consumer awareness regarding environmental issues and the demand for eco-friendly products are propelling market growth. Technological advancements in recycling processes and the development of innovative recycling technologies further contribute to the expansion of the market.

Region Insights:

The market for circular polymers is spread across various regions, with North America, Europe, Asia Pacific, and other regions each contributing to its growth. Europe leads the market, driven by stringent regulations promoting recycling and sustainability. North America follows closely, supported by growing environmental consciousness among consumers and businesses. The Asia Pacific region is witnessing rapid growth due to increasing industrialization, urbanization, and governmental initiatives to tackle plastic waste.

Circular Polymers Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.57% |

| Global Market Size in 2023 | USD 72.40 Billion |

| Global Market Size in 2024 | USD 80.05 Billion |

| Global Market Size by 2033 | USD 197.80 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Polymer Type, By Form, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Circular Polymers Market Dynamics

Drivers:

Several drivers are driving the growth of the Circular Polymers Market. Rising concerns about plastic pollution and its detrimental impact on the environment have led to increased demand for sustainable alternatives such as circular polymers. Additionally, the growing emphasis on corporate social responsibility (CSR) and sustainability targets among companies across various industries is driving the adoption of circular polymer solutions.

Opportunities:

The market presents numerous opportunities for stakeholders. Collaborations between governments, industry players, and research institutions can facilitate the development of advanced recycling technologies and infrastructure. Furthermore, increasing investments in research and development to improve the quality and performance of circular polymers open up new avenues for market expansion. Emerging economies with growing populations and consumption patterns offer untapped opportunities for market penetration.

Challenges:

Despite its promising growth prospects, the Circular Polymers Market faces several challenges. One of the primary challenges is the collection and sorting of post-consumer plastic waste, which requires efficient infrastructure and logistical support. Quality consistency and contamination issues in recycled materials pose challenges to manufacturers seeking to incorporate circular polymers into their products. Additionally, the economic viability of recycling processes and the competitiveness of circular polymers against conventional plastics remain areas of concern. Overcoming these challenges requires concerted efforts from stakeholders across the value chain.

Read Also: Stretch Sleeve and Shrink Sleeve Labels Market Size, Share, Report 2033

Recent Developments

- In September 2023, Chevron Phillips Chemical Company LLC collaborated with Danimer Scientific, formerly known as Meridian Holdings Group Inc., and MHG, a biopolymer manufacturer. This collaboration aimed to utilize Rinnovo polymers produced in a loop slurry reactor process to create biodegradable cast extrusion films, blown extrusion films, injection molded parts, and rational molded parts.

- In July 2023, TotalEnergies SE collaborated with Aramco, SABIC (Saudi Arabia Basic Industries Corporation), a chemical manufacturer. This collaboration aimed to convert oil derived from plastic waste into circular polymers.

- In June 2023, Circular Polymers by Ascend introduced Cerene, a line of recycled polymers and materials made from the company’s proprietary carpet reclaiming technology. The launched product would be available as polyamide 6 and 66, PET, polypropylene, and calcium carbonate as a consistent, sustainable feedstock for many applications consisting of molding and compounding.

- In June 2023, Borealis AG took over Rialti S.p.A., a polypropylene (PP) compounder of recyclates based in the Varese area of Italy. This acquisition aimed to expand Borealis’s PP compounding business and, in particular, increase its volume of PP compounds based on mechanical recyclates.

- In May 2023, Borealis AG launched Bornewables, a line of Queo, a range of plastomers and elastomers based on renewable feedstock. The launched product would allow Borealis to meet increasing customer demand for sustainable solutions that don’t compromise on quality or performance.

Circular Polymers Market Companies

- LyondellBasell Industries Holdings B.V.

- SABIC

- Ascend Performance Materials Operations, LLC

- Advanced Circular Polymers

- Borealis AG

- Veolia

- Exxon Mobil Corporation

- The Shakti Plastic Industries

- Chevron Phillips Chemical Company, LLC

- Suez Group

Segments Covered in the Report

By Polymer Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Others

By Form

- Pellets

- Flakes

By Application

- Food Packaging

- Adhesives & Sealants

- Interior & Exterior Components

- Wires & Cables

- Others

By End-use

- Packaging

- Building & Construction

- Automotive

- Electrical & Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/