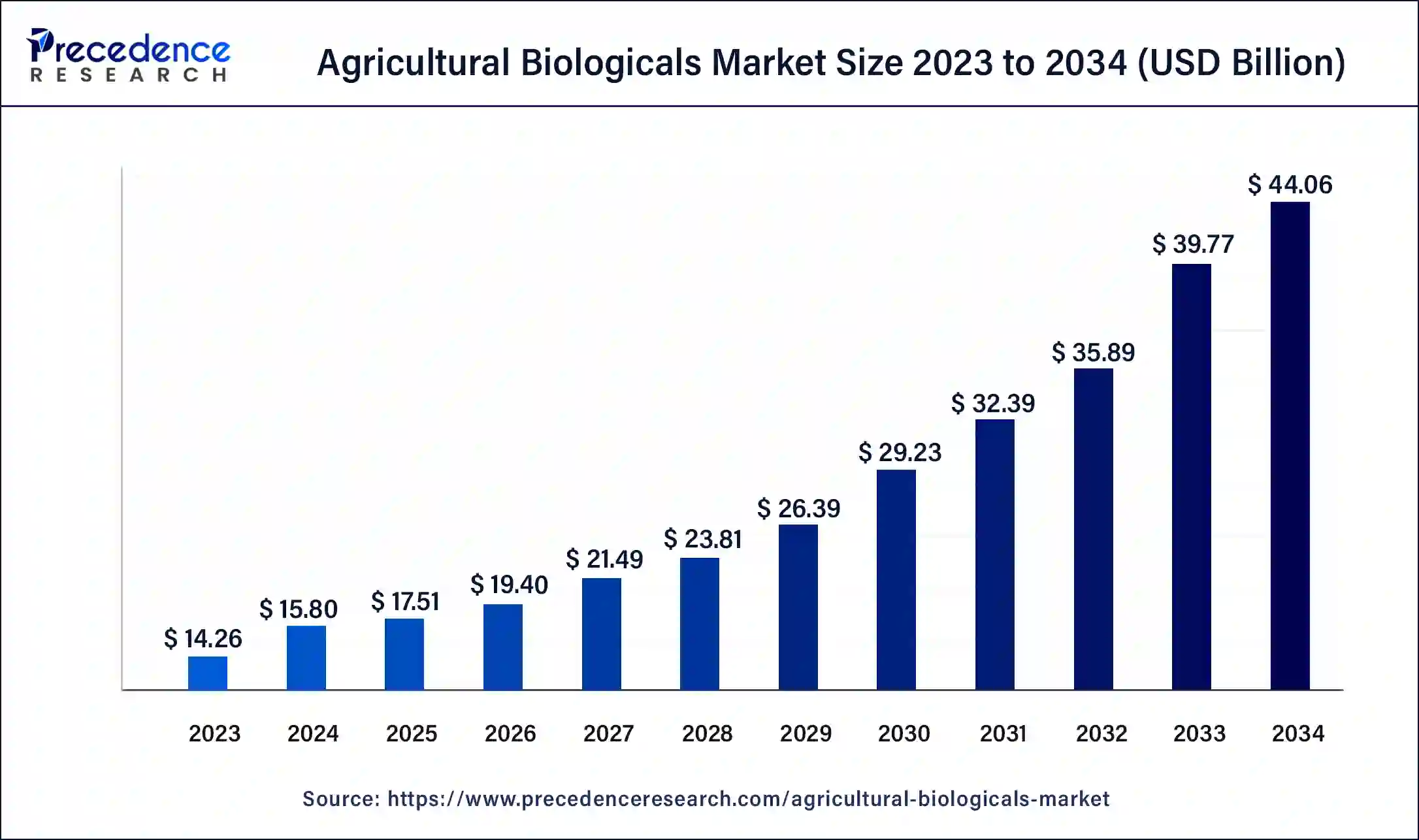

The global agricultural biologicals market size was estimated at USD 14.26 billion in 2023 and is predicted to attain around USD 39.59 billion by 2033, growing at a CAGR of 10.75% from 2024 to 2033.

Key Points

- The North America agricultural biologicals market size reached USD 5.22 billion in 2023 and is expected to be worth around USD 14.49 billion by 2033.

- North America led the agricultural biologicals market with the largest share of 36.6% in 2023.

- By Product, the biopesticides segment dominated the agricultural biologicals market with the largest share 57% in 2023.

- By Application, the foliar spray segment held the dominating share of around 64.5% in 2023.

- By Crop-type, the cereals & grains segment has accounted market share of around 37.4% in 2023.

- By end-user, the biological product manufacturers segment held the largest share of the market in 2023.

The agricultural biologicals market is a rapidly growing sector that encompasses various products derived from natural sources to enhance agricultural productivity, sustainability, and environmental health. Agricultural biologicals include biopesticides, biofertilizers, and biostimulants, among others. These products offer alternative solutions to traditional chemical-based pesticides and fertilizers, focusing on natural, non-toxic, and environmentally friendly options. The market is experiencing significant growth due to increased awareness of the harmful impacts of chemical inputs on human health and the environment.

Get a Sample: https://www.precedenceresearch.com/sample/4084

Growth Factors

- Rising Demand for Organic Produce: Consumers are becoming increasingly health-conscious and seeking organic products free from chemical residues. This trend has prompted farmers to adopt biological solutions to meet market demand for organic produce.

- Environmental Concerns: The impact of chemical-based agricultural practices on the environment, including soil degradation and water pollution, has led to a shift towards sustainable practices. Agricultural biologicals offer an eco-friendly alternative that supports long-term soil health and biodiversity.

- Government Support and Regulations: Many governments are implementing regulations to limit the use of chemical pesticides and fertilizers due to their adverse effects on human health and the environment. This has created a conducive environment for the growth of agricultural biologicals.

- Technological Advancements: Research and development in biotechnology have led to the creation of more effective and targeted biological products. This innovation is driving the adoption of agricultural biologicals as viable alternatives to chemical inputs.

- Cost-Effective Solutions: While initial adoption may require investment, agricultural biologicals can offer cost savings in the long run by improving crop health, reducing chemical inputs, and increasing yields.

Region Insights

- North America: North America is a significant market for agricultural biologicals due to a well-established agriculture sector, strong research infrastructure, and supportive government policies. The region’s demand for organic products also drives the adoption of biological solutions.

- Europe: Europe has stringent regulations on chemical use in agriculture, leading to a greater acceptance of agricultural biologicals. The European Union’s focus on sustainability and organic farming further fuels market growth.

- Asia-Pacific: The Asia-Pacific region is a rapidly growing market due to its large agricultural base and increasing awareness of sustainable practices. Countries like China and India are investing heavily in agricultural innovation, including biologicals.

- Latin America: Latin America is a major producer of crops such as coffee, soybeans, and fruits, making it a key region for agricultural biologicals. The adoption of sustainable practices is growing, particularly in countries like Brazil and Argentina.

- Middle East and Africa: These regions are seeing gradual growth in the agricultural biologicals market due to increasing interest in sustainable agriculture and government initiatives promoting eco-friendly farming.

Agricultural Biologicals Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.75% |

| Global Market Size in 2023 | USD 14.26 Billion |

| Global Market Size in 2024 | USD 15.79 Billion |

| Global Market Size by 2033 | USD 39.59 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Crop-type, By Product, By Application, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Agricultural Biologicals Market Dynamics

Drivers

- Sustainable Agriculture Practices: Farmers are adopting sustainable agricultural methods to maintain soil health, reduce chemical usage, and increase biodiversity. Agricultural biologicals play a key role in achieving these goals.

- Consumer Preferences: Growing consumer demand for organic and naturally produced food is driving farmers to use biological inputs to maintain certification and meet market demand.

- Research and Innovation: Continuous advancements in biotechnology and biological sciences are leading to more effective and efficient biological products, making them a viable alternative to traditional inputs.

- Government Policies: Supportive policies and regulations aimed at reducing chemical use in agriculture encourage the adoption of biologicals.

- Market Potential in Developing Regions: Developing regions offer significant market potential due to their large agricultural sectors and need for sustainable practices.

Challenges

- Lack of Awareness: Farmers may not be fully aware of the benefits and potential of agricultural biologicals, leading to slower adoption rates.

- Regulatory Hurdles: Inconsistent regulations and approval processes for biological products across different regions can pose challenges for market players.

- Efficacy and Reliability: Some farmers may be skeptical of the efficacy and reliability of biologicals compared to chemical inputs, impacting adoption rates.

- High Initial Costs: The initial investment in agricultural biologicals may be higher than traditional methods, which can be a barrier for some farmers.

- Limited Shelf Life: Many biological products have a limited shelf life, requiring careful storage and handling to maintain effectiveness.

Opportunities

- Market Expansion: As awareness of the benefits of agricultural biologicals grows, there is significant potential for market expansion, particularly in developing regions.

- Collaboration and Partnerships: Collaboration between research institutions, governments, and industry players can drive innovation and market growth.

- Product Diversification: Developing new and diversified biological products can help meet the specific needs of different crops and regions.

- Precision Agriculture: The integration of agricultural biologicals with precision agriculture technologies can optimize the use of biologicals and improve crop management.

- Consumer Education: Educating consumers about the benefits of agricultural biologicals can drive demand for naturally produced products, supporting market growth.

Read Also: Smart Medical Devices Market Size to Rake USD 152.30 Bn by 2033

Recent Developments

- In March 2024, Certis Biologicals comes in a strategic collaboration with the SDS Biotech K.K. for the commercialization and development of the agricultural biological products. The partnership aiming the goal is to find the solution for the evolving challenges of the agriculture industry.

- In March 2024, IPL Biologicals launched its latest brand identity and Microbot™ Technology, to celebrate its 30-year-old journey. The latest logo shows the farming community with the representation of growth, sustainability, and nature.

- In June 2023, AgBiome tapped in the agreement with the Ginkgo Bioworks aiming to increase the development of latest agricultural biologicals and enhance existing product that uses in the production of crops.

Agricultural Biological Market Companies

- BASF SE (Germany)

- Syngenta AG (Switzerland)

- Bayer AG (Germany)

- UPL (India)

- Corteva Agriscience (US)

- The Mosaic Company (US)

- Pro Farm Group Inc. (US)

- Gowan Company (US)

- Vegalab SA (Switzerland)

- Lallemand Inc. (Canada)

- Valent BioSciences LLC (US)

Segments Covered in the Report

By Crop-type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Product

- Biopesticides

- Biochemicals

- Microbials

- Biostimulants

- Acid Based

- Seaweed Extract

- Microbials

- Others

- Biofertilizers

- Nitrogen Fixation

- Phosphate Solubilizing

- Others

- Others (Macro-organisms)

By Application

- Foliar Sprays

- Soil Treatment

- Seed Treatment

- Post-harvest

By End-User

- Biological Product Manufacturer

- Government Agencies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/